Setting the Record Straight

Like any Finance pro, I love Excel (who doesn’t?).

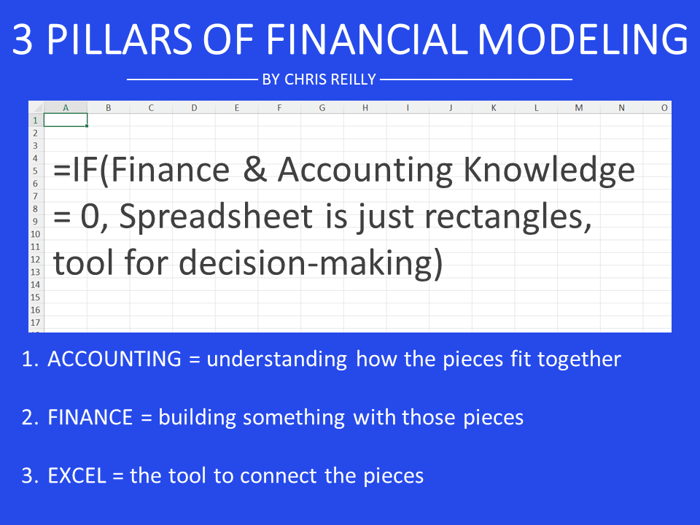

But being good at Excel is just one small piece of being a good modeler, and I’d argue it’s the least important.

Far more helpful is an understanding of Accounting and Finance.

I’ll explain…

Accounting

To build models effectively, you have to know how the pieces fit together.

Imagine a contractor coming to work on your house and trying to install a door where there should be a window.

Would you hire that person? I can only imagine what the roof would look like.

Accounting is the accurate construction of the financial past.

You can’t forecast the future (Finance) until you understand the past.

You don’t need every FASB memorized (I sure don’t), but you should be familiar with these concepts:

- Double-Entry Bookkeeping

- Revenue Recognition

- Accrual Accounting

- Matching Principle

- Journal Entries

- Historical Cost

- Going Concern

- Full Disclosure

- Conservatism

- Consistency

- Materiality

The best place to learn 90% of the list above? Building three statement models.

Finance

Now that we know how the pieces fit together, it’s time to build.

Boiled down to its core, Finance requires us to make estimates about the future and translate those estimates to the fundamental principles we know in Accounting.

After all, we can’t assess the impact of our estimates (Finance) unless we have a context in which to frame and measure them (Accounting).

Again, do you need to know everything under the sun?

No. I’ve forgotten most of what I learned from my CFA exam.

But here a some key concepts to write down:

- Risk and Return Trade-off

- Cash Flow Management

- Time Value of Money

- Capital Budgeting

- Capital Structure

- Financial Ratios

- Cost of Capital

- Leverage

💡Fact: 80% of my FP&A work revolves around Capital Structure, Capital Budgeting, and Cash Flow Management.

Last and Also Least: Excel

(or Google Sheets, whatever)

We all love Excel so much, but it’s the least important of these three skills (there, I said it).

It’s just the way we physically connect the pieces.

Does that make it meaningless?

No. You absolutely need a platform to compile your Accounting and Finance knowledge into a usable tool.

BUT — XLOOKUP, INDEX/MATCH, VLOOKUP — none of that really matters.

Do you think your boss cares which function you used?

There’s a reason your boss can drop a bombshell question 58 minutes into the Zoom call that no one else thought out: they’re thinking about the Accounting and Finance, not Excel.

💡Pro Tip: Instead of binging on Excel shortcuts, if you can master the 80/20 of core Accounting and Finance principles, your modeling will improve as well, because you’ll waste less time on things you used to overcomplicate.

Instead, you’ll know what to focus on and what to ignore.

Excel is great (and I love it, of course), but without underlying knowledge of Accounting and Finance, it’s just a bunch of rectangles.

Action Items

Be honest with yourself, how comfortable are you with:

- The Matching Principle

- Expense Forecasting

- Cash Flow Modeling

- Capital Budgeting

If you’re a little light, you might want to check out my courses. All action, no fluff. We focus on the core concepts that make you a Finance Professional, not just an Excel jockey (but yeah, we’ve got Excel shortcuts in there too).

That’s it for today. See you next time.

— Chris