MASTER THE FUNDAMENTALS BEFORE LEANING ON AI.

Build the Financial Models that Run The Business — in 1 week.

Even if you're working full time.

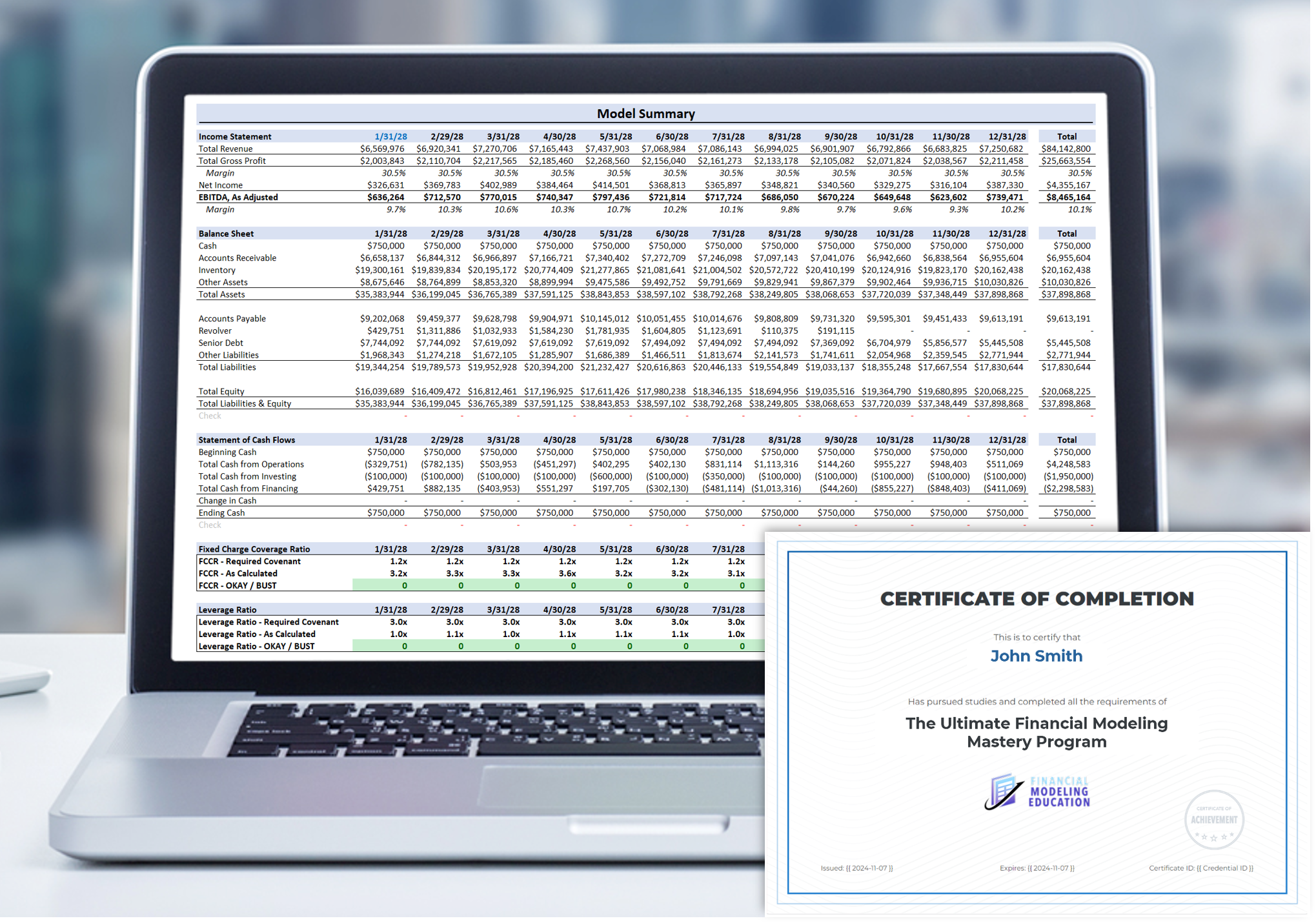

Taught by a Private Equity & FP&A veteran — learn to build 3-Statement Models and 13-week Cash Flow Forecasts to manage budgeting, rolling forecasts, & liquidity.