Intro

I’ve built hundreds of Financial Models over the years, and frankly don’t even want to know how many hours I’ve spent doing so.

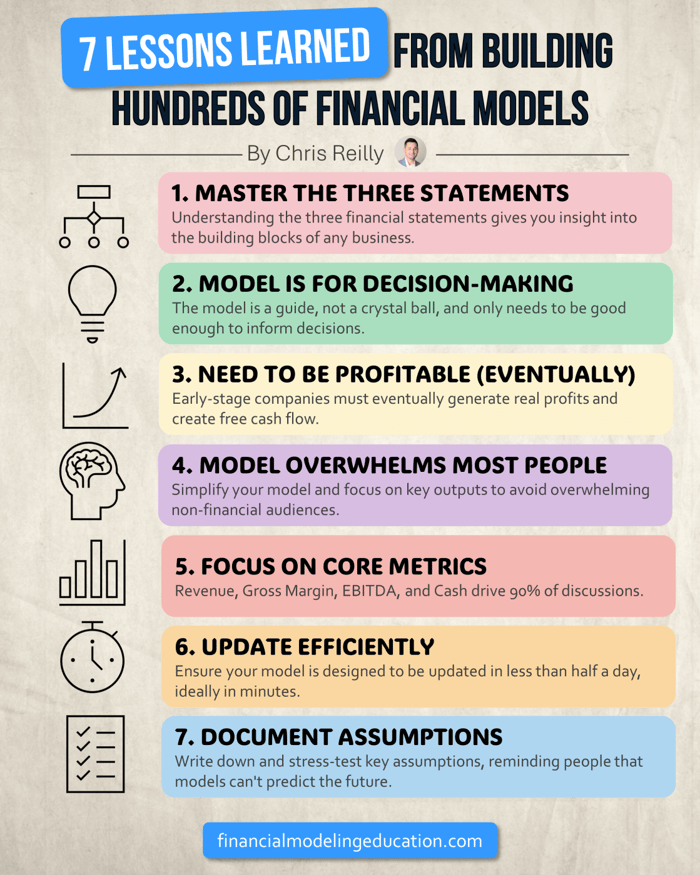

Despite all the different industries, revenue builds, and cost builds, there are seven themes that continually reveal themselves again and again.

Let’s discuss them today…

1. Mastering the Three Statements.

Look, I get that not everybody needs to use three statement modeling on the job.

Nonetheless, understanding it has been the single-most impactful skill of my career.

Foundationally, you learn accounting through Excel, which I found much easier than learning it in the classroom.

And strategically, it helps you lead discussions in the C-Suite, because if you know how the statements link together, then you can communicate how one change affects the entire business.

2. The Model is a decision-making tool.

The model is not the business.

It is an abstract representation of what we hope the business can do if everyone actually goes out and does the work.

It doesn’t need to be perfect and it can’t predict the future. It just needs to be good enough to guide us on what to do next.

3. You’ve got to be profitable (eventually).

I love helping early-stage companies and it’s cool to see them get off the ground.

Eventually, however, the company needs to generate a profit.

Real cash. You can’t continually fundraise forever.

At some point, the business actually needs to create free cash flow.

4. The Model overwhelms most people.

No matter how good you are, the people who understand the model the most are those who created it.

If you’re flipping through rows and rows of complex formulas you’ve completely lost people.

Honestly, when I start seeing more than 15 tabs my mind starts to freak out.

Try to drive home only the key outputs of the model to non-financial people.

Speaking of which…

5. Most people care about Revenue, Gross Margin, EBITDA, and Cash.

I love a good dashboard, who doesn’t. The visuals are nice.

Nonetheless, Revenue, Gross Margin, EBITDA, and Cash drive 90% of the discussion.

KPIs often come as secondary items: helpful context that gives us additional insight on one of the four metrics above.

6. You can’t take 4 days to update the model

Sorry, but the thing has to built well enough that you can get it updated in at most a half-day.

Some of the best models I’ve worked on take less than 20 minutes.

I get that sometimes you’re constrained by data and that’s fine.

What I’m really saying here is make sure the file is designed well enough that your update process is fairly automated.

7. Write down your assumptions

A model is only as good as the assumptions it contains (which sorry to burst your bubble, are often just guesses).

Make sure to write the assumptions down and stress-test the ones that have the largest impact on the file.

A good soundbite for you, “Under the current model assumptions, we are showing [result].”

It reminds people that the model can’t predict the future.

Conclusion

There are other lessons out there, for sure, and there’s no way I could capture them all.

These seven, however, are the most recurring based on all the engagements I’ve done.

If you need a confidence boost to ensure your model is correct, then please consider checking out my courses.

Otherwise, that’s it for today. See you next time.

— Chris