Remember When I Said…

…that FP&A and Private Equity are deeply intertwined?

This post is no exception.

Reminder, the ethos of all my writing:

Belief 1: You can’t build Private Equity Models unless you understand FP&A.

Belief 2: You can’t be strategic in FP&A unless you understand Capital Markets (Private Equity).

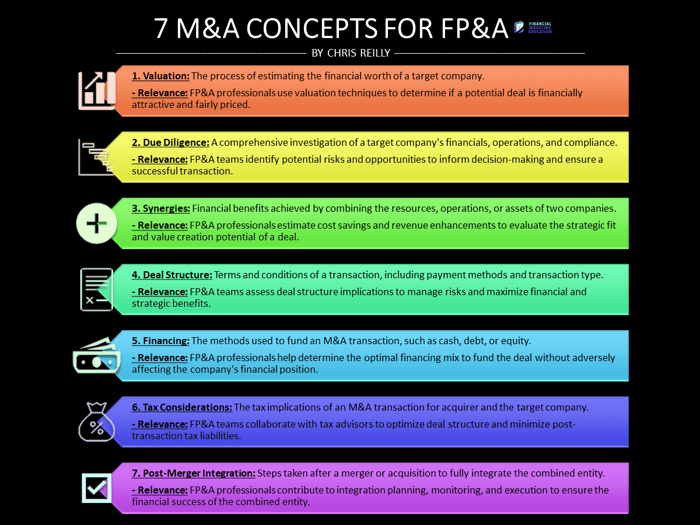

Today, we’re talking 7 M&A Concepts that you need to know if you work in FP&A.

Let’s dive in…

1. Valuation

Definition:

The process of estimating the financial worth of a target company (or price).

Here are several common approaches:

- Comparable Company Analysis (CCA): Compares the company’s financial metrics to similar companies, often using multiples like EV/EBITDA and EV/Revenue.

- Enterprise Value Multiples: Uses metrics like EV/EBITDA to compare companies based on their enterprise value.

- Precedent Transaction Analysis: Looks at recent sales or acquisitions of similar companies to determine valuation multiples.

- Discounted Cash Flow (DCF) Analysis: Projects future cash flows and discounts them back to present value.

- Market Capitalization: Calculates the company’s value by multiplying the share price by the total number of shares outstanding.

And some less-common approaches:

- Liquidation Valuation: Estimates the value of a company’s assets if it were to be liquidated.

- Book Value: Based on the value of a company’s equity as recorded in the financial statements.

- Replacement Cost: Calculates the cost to recreate the company’s assets from scratch.

- Sum of the Parts: Breaks down the company into its components and values each separately.

- Income Capitalization: Converts a company’s income into a present value using a capitalization rate.

- Venture Capital Method (VCM): Estimates the value of a high-growth startup based on its potential for future returns, often used in venture capital investing.

Relevance to FP&A:

At some point in your FP&A career, you will likely have a look at the capital markets and/or explore the possible acquisition of a target company.

If your company is PE-backed, then you will definitely see this happen.

You don’t need all these memorized, but you should be very familiar with the first handful of valuation techniques on the list above.

💡Interesting Tidbit: everyone loves to talk about DCF modeling. I never used it in my Private Equity career. Not once. We were all about Company Comparisons, Precedent Transactions, and Enterprise Value Multiples.

2. Due Diligence

Definition:

A comprehensive investigation of a target company’s financials, operations, and compliance.

Here’s an overview of the process:

(see how the model covers the entire time period?)

Relevance to FP&A:

You won’t be involved in the entire diligence process, but you can bet that you will be involved in some of the financial diligence and modeling.

3. Synergies

Definition:

Probably the most annoying buzzword in all of Finance, but important nonetheless.

Synergies are financial benefits achieved by combining the resources, operations, or assets of two companies.

Here’s an example:

(that’s “synergy”)

Relevance to FP&A:

FP&A professionals will help estimate cost savings and revenue enhancements to evaluate the strategic fit and value creation potential of a deal.

(after all, who knows the financial picture of your company best? You.)

4. Deal Structure

Definition:

The terms and conditions of an M&A transaction, including payment methods and transaction type.

Here are a handful of common structures:

- Leveraged Buyout (LBO): Acquiring a company using a large amount of borrowed funds, often secured by the target’s assets.

- Equity Investment: Capital investment for an ownership stake, which could be either a minority or majority position.

- Preferred Equity: Investment in shares that have priority over common stock for dividends and liquidation proceeds. There is “participating” and “non-participating” Preferred Equity.

- All-Cash Deal: The acquisition is entirely financed with cash, offering immediate liquidity to the target’s shareholders.

- Stock-for-Stock Deal: The purchase is made using the acquirer’s stock, merging the interests of both companies’ shareholders.

- Merger of Equals: Two similarly sized companies combine to form a new entity, equally sharing control and benefits.

- Asset Purchase: Direct acquisition of the target’s assets, both tangible and intangible.

- Stock Purchase: Acquisition of a majority or all of the target company’s stock, thereby obtaining control of its assets and operations.

- Management Buyout (MBO): Company’s executives buy out the business, often financed externally.

Relevance to FP&A:

You’ll need to analyze the impact of different deal structures on the company’s financial health.

These structures will be reflected in financial forecasts and strategy to make sure everything aligns with the company’s long-term goals.

Additionally, you’ll want to quantify risks and assess tax implications to maximize the benefit of the transaction.

5. Financing

Definition:

How we fund the M&A deal.

Main choices: cash, debt, or equity.

Other options? Seller financing, mezzanine financing, earnouts.

Relevance to FP&A:

The goal for FP&A teams is to find the right financing mix.

Evaluate the company’s cash reserves — how much is usable without impacting operations?

- When it comes to Debt, you’ll assess the cost of borrowing, interest rates, and terms. How does this affect our debt levels?

- Equity might mean sharing control. What’s the impact on existing shareholders? Is the dilution worth the potential growth

- Seller Financing can smooth negotiations, allowing payments over time, but is more common in smaller deals or tight markets.

- Mezzanine Financing is versatile, part debt, part potential equity — used often to bridge gaps in financing structures (sometimes called a “stretch piece”).

- Earnouts align payment with future performance, helpful in valuing growth prospects or unproven markets. Just make sure the cash impact of paying the earnout is reflected in the forecast.

Whatever the approach, FP&A will build financial models to simulate scenarios and examine the impact on KPIs to preserve the company’s financial health and alignment with strategic goals.

6. Tax Considerations

Definition:

How taxes impact the M&A deal.

Key factors: corporate structure, deal structure, and location.

Relevance to FP&A:

The goal for FP&A teams is to optimize tax outcomes.

You’ll evaluate how different deal structures — asset vs. stock purchase — impact tax liabilities.

- Asset Purchases might favor the buyer with depreciation benefits. What taxes will this allow us to offset?

- Stock Purchases can have different implications, often affecting the seller’s capital gains tax. How does this influence negotiation?

- Location Matters. Cross-border deals bring complex tax regulations. Are there double taxation risks?

You’re not alone here and will definitely consults with tax experts to figure all this out, but you’ll want a general understanding of the different implications.

7. Post-Merger Integration

Definition:

The process of combining and restructuring two companies into one entity after a merger or acquisition.

Key challenges: aligning cultures, systems, and operations.

Relevance to FP&A:

The goal for FP&A teams is to ensure a smooth and effective integration.

They play a crucial role in merging financial systems and processes. How do we align accounting practices?

Cultural integration is key. How do we merge different company cultures to maintain employee morale and productivity?

FP&A assesses synergies. Are we achieving the cost savings and revenue enhancements we projected?

They track integration costs against budgets. Are unexpected expenses threatening our financial stability?

FP&A provides ongoing reporting and analysis to measure the success of the integration against strategic goals.

💡Need to Know: Culture is #1, #2, and #3 on this list. Yes, you’ll of course need to integrate systems behind-the-scenes, but culture will always take the biggest hit.

Get to know the new people you’ll be working with, understand their company culture, and be sure to communicate yours. It’s a clash of styles that always hurts deals in the end.

In Summary

I don’t expect you to have this entire list memorized, but just be familiar with it.

In your FP&A career, it’s very likely that you will encounter a handful of these topics at some point.

And yes, nearly all of the quantitative elements will appear in your financial model, so make sure you have that skill dialed.

That’s it for today. See you next time.

— Chris