9 Financial Modeling Tips I Wish I Had When I First Started

|

Financial modeling tips: I've been building Financial Models for a long time.

Interestingly enough, there are several "fundamental truths" I see time and again.

These are 9 financial modeling tips I wish I had when I first started...

1. Everything Comes Back to the 3 Statements

Doesn’t matter if you’re building a traditional 3 Statement Operating Model or working on a 40,000-row analysis—it always comes back to the 3 Statements in some way, shape, or form.

I didn't quite realize this when I was younger, and I would get lost in "spreadsheet hell" — just cranking away, not really knowing what part of the business my work was impacting.

Focus on the “real” Big 4:

- Revenue

- Margin

- EBITDA

- Cash

Every change to the business affects those four things, and nearly every Board meeting discusses those topics.

(Never heard "INDEX/MATCH" mentioned at a Board meeting, have you?)

Remembering this will help keep you focused on the big picture.

2. Understand the Matching Principle

The Matching Principle states that Revenue Earned must match Expenses Incurred.

For example, a truck I buy today (with cash) will help me earn Revenue over the next 7 years (by making deliveries), so its expense must be incurred over that same seven-year timeline (as Depreciation), even though I spent the cash today (as Capex).

This is why we have:

- An Income Statement to show the accrual

- A Balance Sheet to show the outstanding amount

- A Cash Flow Statement to bridge the two

3. "If I Could Only Give You 2 of the 3 Statements, What Would You Choose?"

You’d choose the Income Statement and the Balance Sheet, because you can create the Cash Flow Statement from those two!

Net Income (from the Income Statement) + changes in the Balance Sheet = Cash.

This question loves to get tossed around to junior professionals as a quick "gut check," so remember this for your next interview!

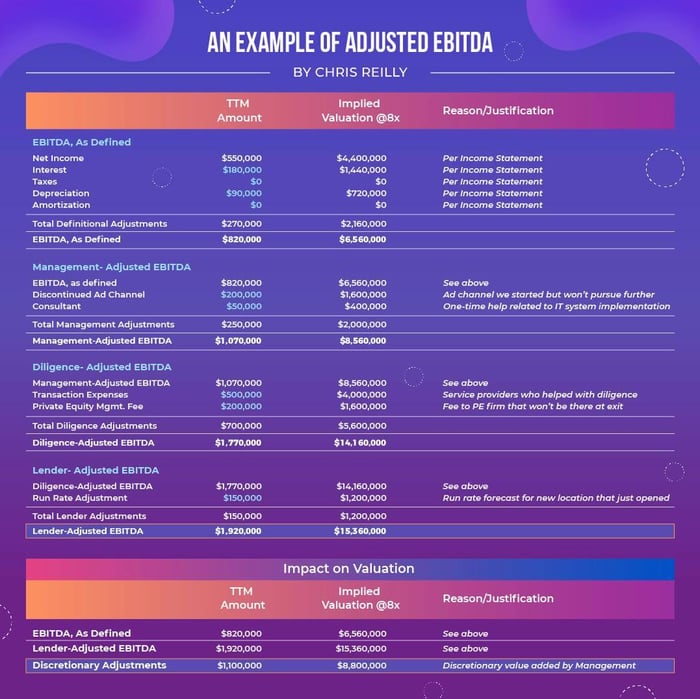

4. Understand the Fundamentals of EBITDA

|

EBITDA is not part of GAAP.

(so you can build it however you please)

EBITDA is a proxy for profitability used to value the business (and sort of helps you figure out approximate operating cash flow).

It gets multiplied by a market multiple (e.g., 8.0x).

EBITDA includes discretionary adjustments, which can significantly affect valuation.

In your model, create rows for every adjustment:

- It will match the Quality of Earnings or "QofE"

- It makes each adjustment easier to discuss

Since EBITDA is a glorified arts-and-crafts project for Finance, each adjustment needs to be scrutinized by the sell-side and the buy-side.

5. Just Because It’s Complicated Doesn’t Make It Good

I’ve built models with 10,000+ inputs because we wanted to “customize everything.”

What happens? File breaks and computer freaks out.

Instead, start with a top-down approach and add details where necessary (think 80/20 rule).

Just like earlier, I start with:

- Revenue

- Margin

- EBITDA

- Cash

Then, add details to the Balance Sheet:

- Working Capital

- Capex

- Debt & Equity Financing, if any

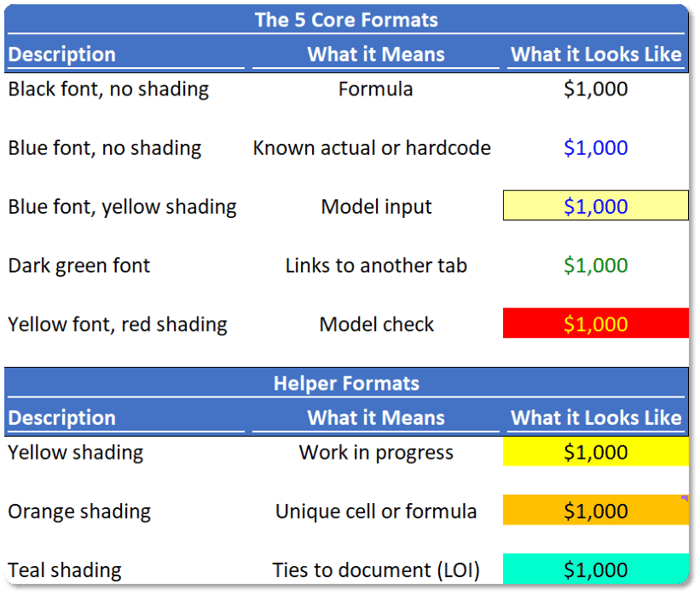

6. Be Consistent with Your Formatting

Everything in life comes with an instruction manual, except for Financial Models: error-prone tools we use to make multi-million dollar decisions.

So it can't hurt to explain what's actually going on in the file, right?

|

Use whatever system you prefer, just be consistent and communicate it to the user.

(this usually goes on the first tab of my model)

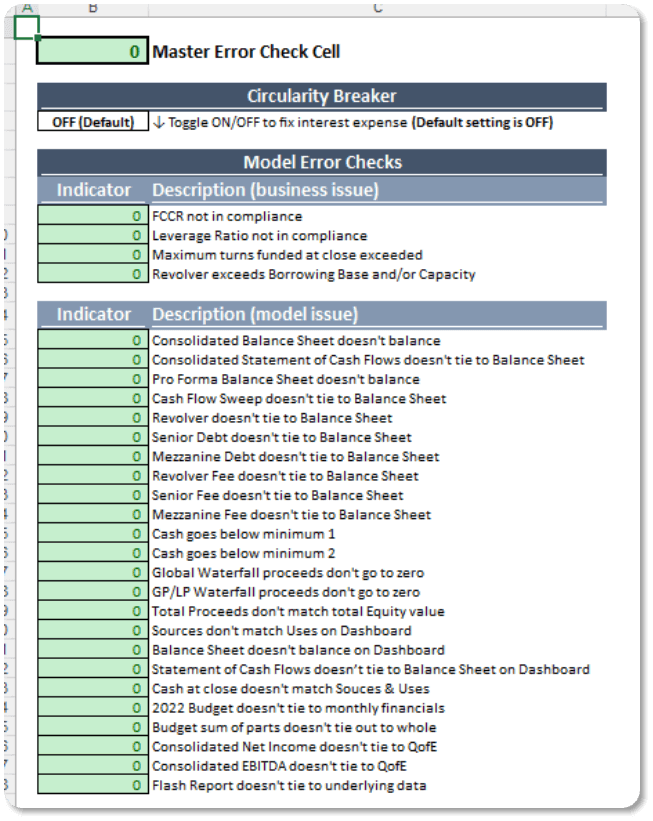

7. Have a Single Place to Check for Errors

Fortunately, I learned this tip over 15 years ago when I was just a green Consultant, but it's stuck with me my entire career.

By the way, guess how many financial models (other than mine) I see implement this technique?

Zero.

And that's brutal because 90% of all spreadsheets contain error. Does yours??

|

Build one tab in your model called "Error Checking" and consolidate all possible issues here.

Then, link your Master Error Check Cell to all tabs in your model.

This way, you can quickly fix any errors that pop up (and trust me, they will).

("Ctrl + [" used in combination with "F5 + Enter" is a quick shortcut you can use to go back-and-forth between your Error Checking tab and the other tabs in your model)

8. Avoid Circularity (Unless…)

Avoid circularity in your model—unless you’re using average debt balances in a 3 Statement Model to calculate interest expense.

(most common in an LBO Model, I'd say)

Build a circularity breaker to temporarily set your interest expense to zero and short-circuit any errors in the model.

Here's a formula you can use:

💡Formula: =if(CircBreak=“ON”,0,[interest expense])

("CircBreak" would be a named range you specify in the file)

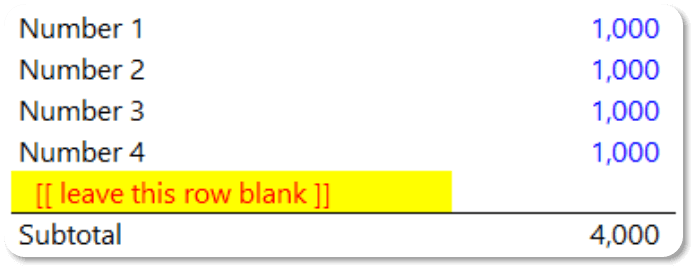

9. Add a Placeholder Row Before Your Subtotal

|

Small trick with a huge impact.

It’s not if, but when, you will have to add new rows (think new customer, new cost, etc.).

Having a blank “placeholder row” allows your =SUM() formula to automatically adjust (or whatever formula you're using).

I still see this mistake every single week, please implement this small change.

Notice anything interesting?

None of these tips are about Excel formulas.

Your boss doesn't care at all about VLOOKUP, INDEX/MATCH, or XLOOKUP (sorry).

Focus on how your model impacts the business.

Use whatever formula you need to get it done, I hope these financial modeling tips can help.

That's it for today. See you next time.

—Chris

p.s., if you enjoyed this post, then please consider checking out my Financial Modeling Courses. As featured by Wharton Online, Wall Street Prep, and LinkedIn Learning, you'll learn to build the exact models I use with Private Equity and FP&A teams around the world. 👉 Click here to learn more.