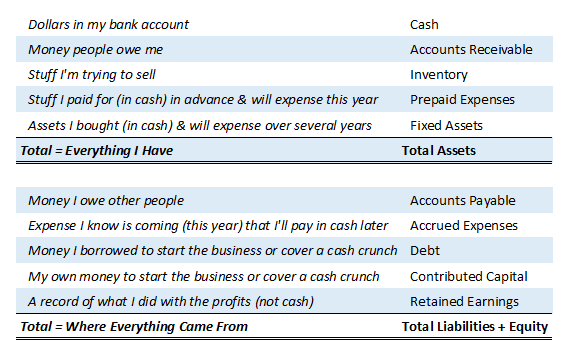

A balance sheet for the rest of us. I've gotta say it drives me nuts when all these finance terms are super opaque and confusing.

For real just tell me what it is in a language I can understand.

Well, here you go -- see below ↓

🟢 𝗖𝗮𝘀𝗵

𝘋𝘰𝘭𝘭𝘢𝘳𝘴 𝘪𝘯 𝘮𝘺 𝘣𝘢𝘯𝘬 𝘢𝘤𝘤𝘰𝘶𝘯𝘵

🟢 𝗔𝗰𝗰𝗼𝘂𝗻𝘁𝘀 𝗥𝗲𝗰𝗲𝗶𝘃𝗮𝗯𝗹𝗲

𝘔𝘰𝘯𝘦𝘺 𝘱𝘦𝘰𝘱𝘭𝘦 𝘰𝘸𝘦 𝘮𝘦

🟢 𝗜𝗻𝘃𝗲𝗻𝘁𝗼𝗿𝘆

𝘚𝘵𝘶𝘧𝘧 𝘐'𝘮 𝘵𝘳𝘺𝘪𝘯𝘨 𝘵𝘰 𝘴𝘦𝘭𝘭

🟢 𝗣𝗿𝗲𝗽𝗮𝗶𝗱 𝗘𝘅𝗽𝗲𝗻𝘀𝗲𝘀

𝘚𝘵𝘶𝘧𝘧 𝘐 𝘱𝘢𝘪𝘥 𝘧𝘰𝘳 (𝘪𝘯 𝘤𝘢𝘴𝘩) 𝘪𝘯 𝘢𝘥𝘷𝘢𝘯𝘤𝘦, 𝘣𝘶𝘵 𝘸𝘪𝘭𝘭 "𝘦𝘹𝘱𝘦𝘯𝘴𝘦" 𝘰𝘷𝘦𝘳 𝘵𝘩𝘦 𝘤𝘰𝘶𝘳𝘴𝘦 𝘰𝘧 𝘵𝘩𝘦 𝘺𝘦𝘢𝘳

(* 𝘔𝘰𝘳𝘦 𝘰𝘯 𝘵𝘩𝘪𝘴 𝘪𝘯 𝘢 𝘴𝘦𝘤 ↓)

🟢 𝗙𝗶𝘅𝗲𝗱 𝗔𝘀𝘀𝗲𝘁𝘀

𝘈𝘴𝘴𝘦𝘵𝘴 𝘐 𝘣𝘰𝘶𝘨𝘩𝘵 (𝘸𝘪𝘵𝘩 𝘤𝘢𝘴𝘩) 𝘣𝘶𝘵 𝘸𝘪𝘭𝘭 "𝘦𝘹𝘱𝘦𝘯𝘴𝘦" 𝘰𝘷𝘦𝘳 𝘴𝘦𝘷𝘦𝘳𝘢𝘭 𝘺𝘦𝘢𝘳𝘴

What do I mean?

Let's say I bought a truck. Why didn't I expense it all at once?

It all comes back to the "matching principle,"

which says my Revenue "earned" needs to match my Expenses "incurred."

("earned" and "incurred" do 𝗡𝗢𝗧 necessarily mean "cash") → that's the key.

For example,

If I do 1 hour of consulting work, I've "earned" it, but haven't been paid in cash.

Okay so with that in mind...

Let's say the truck helps me generate Revenue over the next 5 years.

(by helping me make deliveries, etc.)

Since my Revenue 𝘦𝘢𝘳𝘯𝘦𝘥 must match my Expenses 𝘪𝘯𝘤𝘶𝘳𝘳𝘦𝘥,

I'm going to expense the truck over 5 years to 𝙢𝙖𝙩𝙘𝙝 the Revenue.

(and not all at once)

🟢 𝗔𝗰𝗰𝗼𝘂𝗻𝘁𝘀 𝗣𝗮𝘆𝗮𝗯𝗹𝗲

𝘔𝘰𝘯𝘦𝘺 𝘐 𝘰𝘸𝘦 𝘰𝘵𝘩𝘦𝘳 𝘱𝘦𝘰𝘱𝘭𝘦

(Fun fact, my Accounts Payable is 𝘴𝘰𝘮𝘦𝘰𝘯𝘦 𝘦𝘭𝘴𝘦'𝘴 Accounts Receivable)

🟢 𝗔𝗰𝗰𝗿𝘂𝗲𝗱 𝗘𝘅𝗽𝗲𝗻𝘀𝗲𝘀

𝘌𝘹𝘱𝘦𝘯𝘴𝘦 𝘐 𝘬𝘯𝘰𝘸 𝘪𝘴 𝘤𝘰𝘮𝘪𝘯𝘨 (𝘸𝘪𝘵𝘩𝘪𝘯 𝘢 𝘺𝘦𝘢𝘳) 𝘵𝘩𝘢𝘵 𝘐'𝘭𝘭 𝘱𝘢𝘺 𝘧𝘰𝘳 𝘭𝘢𝘵𝘦𝘳 𝘪𝘯 𝘤𝘢𝘴𝘩 (𝘣𝘶𝘵 𝘐 𝘪𝘯𝘤𝘶𝘳 𝘪𝘵 𝘢𝘭𝘰𝘯𝘨 𝘵𝘩𝘦 𝘸𝘢𝘺)

Example: I plan to pay out a $1,200 cash bonus in January 2023,

but I incur ("accrue") a $100 expense every month during 2022.

🟢 𝗗𝗲𝗯𝘁

𝘔𝘰𝘯𝘦𝘺 𝘐 𝘣𝘰𝘳𝘳𝘰𝘸𝘦𝘥 𝘵𝘰 𝘩𝘦𝘭𝘱 𝘴𝘵𝘢𝘳𝘵 𝘵𝘩𝘦 𝘣𝘶𝘴𝘪𝘯𝘦𝘴𝘴 𝘰𝘳 𝘤𝘰𝘷𝘦𝘳 𝘮𝘦 𝘥𝘶𝘳𝘪𝘯𝘨 𝘢 𝘤𝘢𝘴𝘩 𝘤𝘳𝘶𝘯𝘤𝘩

🟢 𝗖𝗼𝗻𝘁𝗿𝗶𝗯𝘂𝘁𝗲𝗱 𝗖𝗮𝗽𝗶𝘁𝗮𝗹

𝘔𝘺 𝘰𝘸𝘯 𝘮𝘰𝘯𝘦𝘺 𝘐 𝘶𝘴𝘦𝘥 𝘵𝘰 𝘴𝘵𝘢𝘳𝘵 𝘵𝘩𝘦 𝘣𝘶𝘴𝘪𝘯𝘦𝘴𝘴 𝘰𝘳 𝘤𝘰𝘷𝘦𝘳 𝘮𝘦 𝘥𝘶𝘳𝘪𝘯𝘨 𝘢 𝘤𝘢𝘴𝘩 𝘤𝘳𝘶𝘯𝘤𝘩 (𝘪𝘯𝘴𝘵𝘦𝘢𝘥 𝘰𝘧 𝘣𝘰𝘳𝘳𝘰𝘸𝘪𝘯𝘨 𝘪𝘵)

🟢 𝗥𝗲𝘁𝗮𝗶𝗻𝗲𝗱 𝗘𝗮𝗿𝗻𝗶𝗻𝗴𝘀

𝘈 𝘳𝘦𝘤𝘰𝘳𝘥 𝘰𝘧 𝘸𝘩𝘢𝘵 𝘐 𝘥𝘪𝘥 𝘸𝘪𝘵𝘩 𝘵𝘩𝘦 𝘣𝘶𝘴𝘪𝘯𝘦𝘴𝘴 𝘱𝘳𝘰𝘧𝘪𝘵𝘴

(either put back into the business or taken out with a distribution)

(↑ Retained Earnings is 𝗡𝗢𝗧 cash, it's just a record)

🟢 Why must my 𝗧𝗼𝘁𝗮𝗹 𝗔𝘀𝘀𝗲𝘁𝘀 = 𝗧𝗼𝘁𝗮𝗹 𝗟𝗶𝗮𝗯𝗶𝗹𝗶𝘁𝗶𝗲𝘀 + 𝗘𝗾𝘂𝗶𝘁𝘆?

Total Assets = 𝘦𝘷𝘦𝘳𝘺𝘵𝘩𝘪𝘯𝘨 𝘐 𝘩𝘢𝘷𝘦

Liabilities & Equity = 𝘸𝘩𝘦𝘳𝘦 𝘦𝘷𝘦𝘳𝘺𝘵𝘩𝘪𝘯𝘨 𝘤𝘢𝘮𝘦 𝘧𝘳𝘰𝘮

———

About Me -- I'm Chris. I help with M&A, FP&A, and teach financial modeling like a human, not a textbook. Here are the best ways I can help you:

- Learn the Basic 3 Statements

- Download my Advanced 3 Statement Model Template

- Learn to model like a Private Equity pro