A beautiful, yet tricky, part of the modeling equation...

What are the 𝗦𝗼𝘂𝗿𝗰𝗲𝘀 & 𝗨𝘀𝗲𝘀?

𝗭𝗼𝗼𝗺 𝗢𝘂𝘁: the Sources & Uses show 𝘩𝘰𝘸 a company is purchased (Sources) and 𝘸𝘩𝘦𝘳𝘦 the proceeds go (Uses).

But first — let's simplify.

I wish it was called the "Uses & Sources" and not the other way around.

It's easier to understand that way.

Here's an example:

You go to the grocery story and buy 3 things:

1. Apples

2. Cheese

3. Milk

To keep our example simple let's assume they each cost $10.

When you go to check out, you have to pay for your groceries somehow.

Our total price is $30, and that is the "Uses."

$30 gets 𝘶𝘴𝘦𝘥 to pay the grocery store.

———

Okay, so I know my Uses, but now I need a Source.

I could pay with cash, a debit card, or a credit card.

(↑ 𝘰𝘳 𝘦𝘷𝘦𝘯 𝘢 𝘤𝘰𝘮𝘣𝘰)

It just needs to match my Uses, the $30.

Let's say I use my credit card and charge $30.

That's my 𝘴𝘰𝘶𝘳𝘤𝘦.

$30 𝙨𝙤𝙪𝙧𝙘𝙚𝙙 from my credit card to pay $30 to the grocery store (𝙪𝙨𝙚).

Most importantly: THEY MATCH.

———

In a PE/M&A Transaction, a company is purchased the same way.

Sources & Uses.

(𝘰𝘳 𝘳𝘦𝘢𝘭𝘭𝘺, 𝘜𝘴𝘦𝘴 & 𝘚𝘰𝘶𝘳𝘤𝘦𝘴)

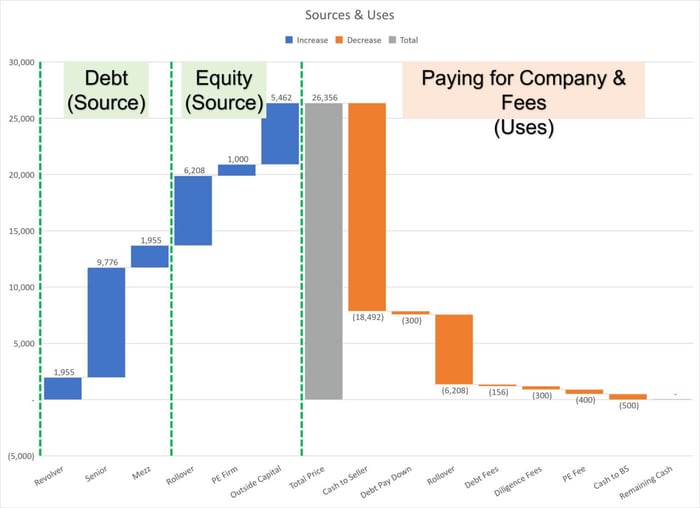

Look at the image below,

the total cost of the company (including fees) is $26,356 (the gray bar).

The orange bars are the Uses,

and you can see most of that goes to pay the Seller (b/c they just sold their company),

but other parts pay for things like debt, fees, and something called "rollover."

("𝘳𝘰𝘭𝘭𝘰𝘷𝘦𝘳" 𝘪𝘴 𝘢 𝘵𝘰𝘱𝘪𝘤 𝘧𝘰𝘳 𝘢𝘯𝘰𝘵𝘩𝘦𝘳 𝘥𝘢𝘺)

———

The blue bars are the Sources,

and you can see the PE firm used a combo of debt and equity to buy the company.

Debt: Revolver, Senior, Mezz

Equity: Rollover, PE Firm, Outside Capital

Most importantly: The Sources 𝙢𝙖𝙩𝙘𝙝 the Uses.

———

Since the Sources & Uses match here,

they will match in our Balance Sheet as well (and keep us balanced!).

The Debt & Equity will increase (for a total of $26,356),

all the Assets will be marked to "fair market value,"

and anything in excess of the Asset values will go to Goodwill.

That's how we stay in balance.

———

For a complicated roll-up model?

I just put the whole transaction into Goodwill.

That way, here's what I see in my Statement of Cash Flows:

Financing Section: the new Debt & Equity

Investing Section: the purchase of the Company

(𝘦𝘹𝘤𝘦𝘱𝘵 𝘧𝘰𝘳 𝘧𝘦𝘦𝘴, 𝘵𝘩𝘦𝘺 𝘨𝘰 𝘵𝘰 𝘵𝘩𝘦 𝘐𝘯𝘤𝘰𝘮𝘦 𝘚𝘵𝘢𝘵𝘦𝘮𝘦𝘯𝘵)

Once the deal closes, a professional firm will come in and put together an "opening day balance sheet" that correctly marks the Assets to "fair value."

My job is to build a cash flow model to get the deal done, so I keep it simpler where I can.

———

So there you have it. The Sources & Uses.

I hope you found this helpful.

—Chris

If and when the time is right, I offer refreshingly straightforward Financial Modeling Courses for FP&A and Private Equity Professionals that have been recognized all over the world. Check them out if you're interested (if not, that's cool too 👍). Just click here.