If I suddenly awoke in the middle of a business and had no idea about anything,

know what I'd build first? Hint: it's 𝙣𝙤𝙩 a three statement model.

It would be a cash flow forecast.

13 weeks, 4 weeks, 7 weeks?

Doesn't matter & I don't care.

I just need a general sense of what my cash will do in the short term.

When will I collect payments?

Can I pay vendors?

Can I make payroll?

———

What drives me nuts about these forecasts?

They have become so overly "professionalized" that no one understands them.

The "Rolling Thirteen Week Cash Flow Forecast" is so unnecessarily official.

I just want to know:

"what will my bank account look like next week?"

"how about 2 weeks from now?"

Enough of the fluff.

———

Open a spreadsheet and whip this thing together.

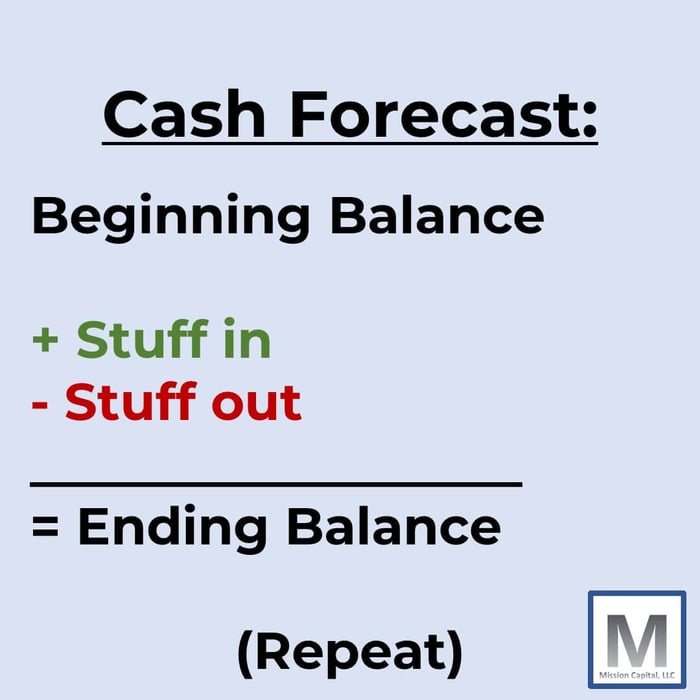

You build it like this:

1. Stuff that comes in

-- minus --

2. Stuff that goes out

=

What you have left.

(repeat for next week)

That's it. Okay?

That's a cash flow forecast.

It doesn't have to be complicated or professional.

You just need to know whether or not you can keep the lights on next week.

———

𝘗𝘳𝘰 𝘵𝘪𝘱 1: have unknowns? Just build a line called "unknowns" to make things conservative.

𝘗𝘳𝘰 𝘵𝘪𝘱 2: forecast expenses early, receipts late (again, make it conservative)

𝘗𝘳𝘰 𝘵𝘪𝘱 3: 𝗳𝗼𝗿𝗴𝗲𝘁 𝗮𝗯𝗼𝘂𝘁 𝘄𝗲𝗲𝗸𝘀, 𝗷𝘂𝘀𝘁 𝗯𝘂𝗶𝗹𝗱 𝗶𝘁 𝗯𝘆 𝗱𝗮𝘆.

Two Reasons for Pro Tip 3:

𝟭. 𝗧𝗶𝗺𝗶𝗻𝗴 𝗱𝘂𝗿𝗶𝗻𝗴 𝘁𝗵𝗲 𝘄𝗲𝗲𝗸

What if you've got big expenses going out on Monday,

and big receipts coming in on Friday?

Your weekly ending balance is probably positive, but...

you could be in the negative on Wednesday.

𝟮. 𝗘𝘅𝗰𝗲𝗹-𝗮𝗯𝗶𝗹𝗶𝘁𝘆 (𝗻𝗲𝘄 𝘄𝗼𝗿𝗱)

It's much easier to build Excel formulas that trigger according to days of the month instead of weeks.

You can always "roll it up" into a weekly summary when you're done.

Think about it, what's easier to build?

▪️ A credit card payment that hits on the 25th day of each month? Or;

▪️ A credit card payment that always hits in week 4?

- then what about February? Is it still the right week?

- what about a longer month, is it still right?

- See what I'm saying? Choosing a day is much easier.

(Just "roll it up" at the end)

And before you tell me the easy way you've figured out to build it weekly...

No offense but that's not the point.

The point is the result.

The cash.

The ending balance.

Not how fancy your file is.

———

Want practice?

Start with your own life:

- paycheck in

- expenses out

That's it.

Try to look 4 weeks out.

How'd you do?

If you were even 𝘥𝘪𝘳𝘦𝘤𝘵𝘪𝘰𝘯𝘢𝘭𝘭𝘺 close,

you have the raw skills to do this analysis at the business level.

Hope this helps.

About Me -- If you've never seen my stuff before, I'm Chris -- from skyscraper to Solopreneur -- I help middle market companies with M&A and FP&A and teach Financial Modeling.

Whenever you're ready, please check out my financial modeling courses -- everything in one place, packed with bonus features, all at a reduce price: Click here.

⭐⭐⭐⭐⭐"So thorough and helpful. Probably the best course on modeling I’ve taken."

Until next time.

—Chris