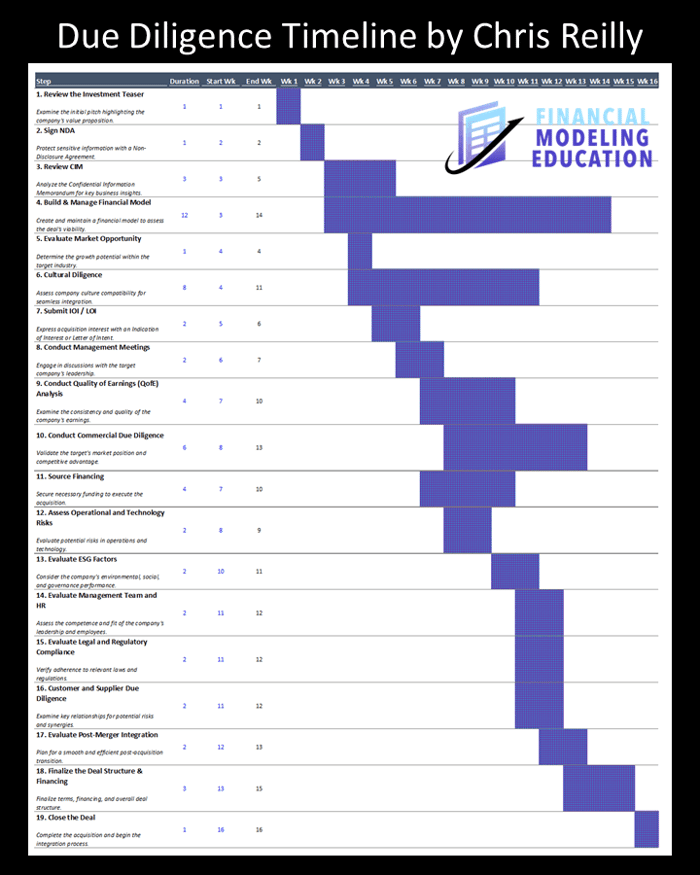

1. Review the Investment Teaser

Examine the initial pitch highlighting the company's value proposition.

2. Sign NDA

Protect sensitive information with a Non-Disclosure Agreement.

3. Review CIM

Analyze the Confidential Information Memorandum for key business insights.

4. Build & Manage Financial Model

Create and maintain a financial model to assess the deal's viability.

5. Evaluate Market Opportunity

Determine the growth potential within the target industry.

6. Cultural Diligence

Assess company culture compatibility for seamless integration.

7. Submit IOI / LOI

Express acquisition interest with an Indication of Interest or Letter of Intent.

8. Conduct Management Meetings

Engage in discussions with the target company's leadership.

9. Conduct Quality of Earnings (QofE) Analysis

Examine the consistency and quality of the company's earnings.

10. Conduct Commercial Due Diligence

Validate the target's market position and competitive advantage.

11. Source Financing

Secure necessary funding to execute the acquisition.

12. Assess Operational and Technology Risks

Evaluate potential risks in operations and technology.

13. Evaluate ESG Factors

Consider the company's environmental, social, and governance performance.

14. Evaluate Management Team and HR

Assess the competence and fit of the company's leadership and employees.

15. Evaluate Legal and Regulatory Compliance

Verify adherence to relevant laws and regulations.

16. Customer and Supplier Due Diligence

Examine key relationships for potential risks and synergies.

17. Evaluate Post-Merger Integration

Plan for a smooth and efficient post-acquisition transition.

18. Finalize the Deal Structure & Financing

Finalize terms, financing, and overall deal structure.

19. Close the Deal

Complete the acquisition and begin the integration process.

Every deal will be different with certain elements added, edited, or removed, but this is a decent place to start.

How I can Help Further

If and when the time is right, I offer refreshingly straightforward Financial Modeling Courses for FP&A and Private Equity Professionals. Join over 2,000 Financial Modelers here.