Welcome to Part Three!

Welcome to Part Three of the Financial Modeling Educator.

I'm assuming you feel pretty good about the basics (modeling best practices and building the three statements), so now we get into the weeds.

Going forward, we'll be discussing Private Equity and FP&A in tandem because they are so intertwined.

This week, we start off with the big picture. What's it even like to purchase a company? Close a deal? When I first got into Private Equity I had no idea.

This post breaks it down...

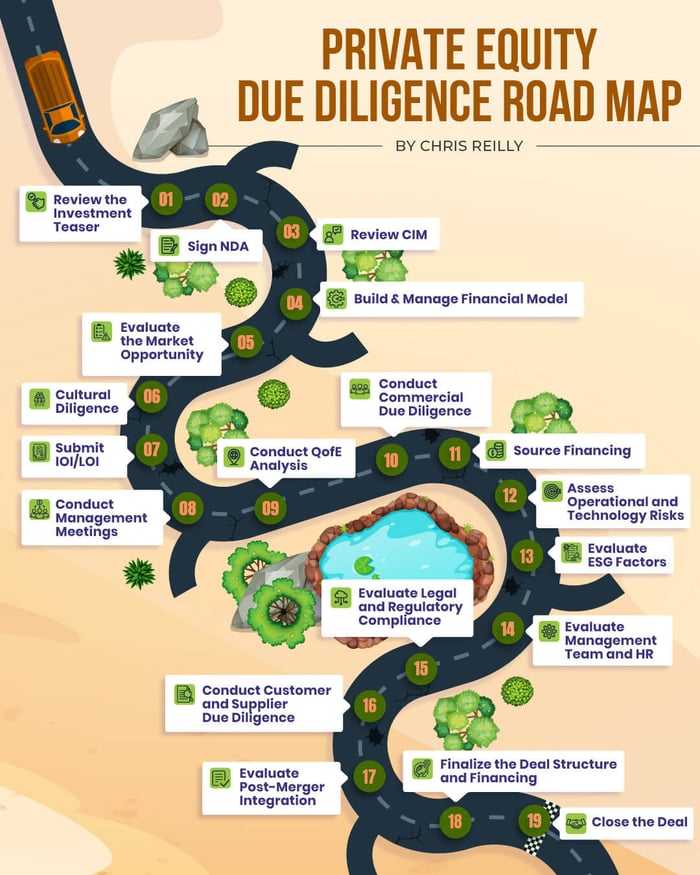

The Rocky Road to Closing a Deal

Closing a deal in private equity is a ton of work for buyers, sellers, and employees.

But, what exactly does that process look like?

Today we explore each step along the way.

(This email is a beast, so be sure to save it as a point of reference in the future. Think of it like your due diligence playbook.)

Review the Investment Teaser

- What: A brief document containing key information about a business looking for funding.

- Why: It gives potential investors a snapshot of the company's offering.

- Financial Model Impact: It provides initial data points for constructing a financial model.

Sign NDA

- What: A legal contract to protect confidential information.

- Why: It ensures sensitive information shared during due diligence is kept confidential.

- Financial Model Impact: It safeguards the proprietary financial data used in the financial model.

Review CIM

- What: Short for "Confidential Information Memorandum," the CIM is a detailed document provided by the target company with in-depth information about its business (usually 60-100 pages). For lack of a better term, this document becomes the "Bible" of the deal, and it will be glued to your hip for six to nine months.

- Why: It helps investors gain a thorough understanding of the target business and dives into all the company details.

- Financial Model Impact: It provides detailed financial information that feeds directly into the financial model (there's a "Financials" section in the CIM).

Build and Manage the Financial Model

- What: The tool used to forecast a business's financial performance and its return on potential investment.

- Why: It helps in evaluating the business's potential and profitability and if the deal is worth taking on (the whole point of doing this in the first place).

- Financial Model Impact: It forms the basis for investment decisions and deal valuation and will be updated monthly as new information comes in. It will also map to the QofE (more on this later) line-for-line.

Evaluate the Market Opportunity

- What: This is the process of assessing the size and attractiveness of the market a business operates in. You'll hear acronyms like TAM, SAM, SOM, etc. These are often "directional" and rarely precise, but they help set goal posts.

- Why: It helps investors understand the potential growth of the business and how much "white space" there is to grow.

- Financial Model Impact: It informs revenue growth assumptions in the financial model. Market size may limit the total growth projections. For example, think about a local company that only operates in one state (not common but possible). The market would be limited in size to the region the company could service.

Cultural Diligence

- What: This involves evaluating the culture of the target company.

- Why: It helps assess if the company's culture aligns with that of the investor or acquirer. All businesses are people at the end of the day, and you need to understand if styles will align post-closing.

- Financial Model Impact: Not a huge impact, but cultural misalignment can lead to post-acquisition integration costs, which would affect the financial model (though, you probably wouldn't model something like this in diligence). This is also a good time to remember that a financial model is nothing more than numbers on a spreadsheet. An abstract representation of a possible reality. If people can't get along and unite around a common vision, all the financial modeling in the world can't save you. So even though "cultural impact" probably isn't a line item in your model, it's paramount throughout diligence that you can see everyone as long term partners.

Submit IOI/LOI

- What: The Indication of Interest (IOI) and Letter of Intent (LOI) are documents expressing interest to proceed with the deal. Some deals have IOIs (shorter and more general) and LOIs (longer and specific), whereas some deals just go straight to LOI.

- Why: They formally commence the negotiation process and say "we're interested in moving forward."

- Financial Model Impact: They reflect the preliminary valuation derived from the financial model. The LOI always "moves around" a little bit, so make sure your model ties exactly to the latest version of the LOI, and build double-checks in the file to ensure accuracy.

Conduct Management Meetings

- What: Meetings with the target company's management team to understand their strategy and vision (usually done onsite).

- Why: These meetings provide qualitative insights that complement the financial data, and like I said earlier, all business are people: we need to understand, "will we all get along?"

- Financial Model Impact: This is a qualitative step in diligence, but sometimes insights from management can inform future performance assumptions in the financial model, like adding or removing revenue streams, etc.

Conduct Quality of Earnings Analysis

- What: Performed by an independent third party, the Quality of Earnings or "QofE" is a deep dive into the company's earnings to ascertain their quality and sustainability (often another 30-60 page document).

- Why: It helps investors understand the true earning capacity of the business.

- Financial Model Impact: The big report coming out of the QofE is the "Adjusted EBITDA," in other words, the normalized profitability of the company after adjusting for one-time / non-recurring items. Adjusted EBITDA from the QofE needs to match your model exactly, and doing it line-by-line is the easiest way.

Conduct Commercial Due Diligence

- What: This involves evaluating the company's market position, customer relationships, product quality, and competitiveness. Basically, a wholistic review of nearly everything about the company other than Legal (comes later).

- Why: It helps identify potential risks and opportunities of the acquisition. Just to throw an annoying buzzword out there, this is "how the sausage is made."

- Financial Model Impact: It can alter revenue and cost projections in the financial model based on identified opportunities and risks. You may find yourself inserting a lot of lines in the P&L with on/off toggles as you assess the impact of various risks or opportunities uncovered during this stage (i.e., new product line on/off, hiring new people on/off, etc.).

Source Financing

- What: This involves securing the necessary funds to complete the acquisition and usually involves talking to a commercial bank for a Leveraged Buyout (LBO).

- Why: Unless it's an "all equity" VC deal or Growth Equity deal, you will likely need to raise outside debt capital.

- Financial Model Impact: The cost and structure of financing impacts the financial model and the calculation of returns. Capturing this part correctly is critical. You'll need to include the correct debt structures, interest expense, and cash flow sweeps according to term sheets provided by the lender. Also, make sure your model is clean! You will be sending it directly to lenders.

Assess Operational and Technology Risks

- What: This involves evaluating the company's operational efficiency and technology readiness. In my opinion, this seems to happen in conjunction with Commercial Due Diligence but they're often called out separately since this has a strictly technological / operational focus.

- Why: It identifies potential vulnerabilities in the company's operations or technology.

- Financial Model Impact: Identified risks and related mitigation costs need to be reflected in the financial model, affecting cost estimates and revenue projections.

Evaluate ESG Factors

- What: This involves assessing the company's Environmental, Social, and Governance (ESG) practices.

- Why: ESG factors are increasingly important to stakeholders and can impact the company's reputation and regulatory standing.

- Financial Model Impact: ESG risks or opportunities can influence operational costs, potential revenues, and risk mitigation expenses in the financial model.

Evaluate Management Team and HR

- What: This process evaluates the skills, experience, and effectiveness of the management team and HR practices.

- Why: The quality of management and HR can significantly impact the success of the business and the partnership. In truth, the acquiring firm has been evaluating the Management Team since the first onsite meeting. This is an ongoing process.

- Financial Model Impact: Changes in management or HR practices can result in additional costs or savings, influencing the financial model. Most commonly, if the acquiring firm thinks the Controller/CFO of the company lacks financial sophistication, you will often build in the cost of a new CFO into the model.

Evaluate Legal and Regulatory Compliance

- What: Performed by a law firm, this involves checking the company's compliance with relevant laws and regulations. Legal diligence typically comes later in the process because the acquiring firm doesn't want to pay lawyers to evaluate a deal unless they're serious about completing the transaction (lawyers are expensive!).

- Why: Non-compliance can result in legal penalties and reputational damage (and can also kill the deal).

- Financial Model Impact: Legal risks and potential penalties need to be accounted for as contingencies in the financial model. The lawyer fees will also go into the Sources and Uses schedule to be paid at closing (along with other third-party providers).

Conduct Customer and Supplier Due Diligence

- What: This involves examining the company's relationships with its key customers and suppliers.

- Why: Stability and strength of these relationships are critical for the company's continued success.

- Financial Model Impact: The potential loss or gain of key customers or suppliers can influence revenue and cost assumptions in the financial model, and "customer concentration" will be a key analysis early on. For example, let's say 80% of all Revenue comes from one customer. If that customer goes away, the deal is effectively dead. So your model will certainly have an on/off toggle to explore this impact.

Evaluate Post-Merger Integration

- What: This involves planning for the integration of the company post-acquisition usually summarized in a "100-day Plan."

- Why: Successful integration is critical to realize the full value of the acquisition.

- Financial Model Impact: Costs associated with post-merger integration need to be factored into the financial model. There could be consultants to help with integration, new software and accounting systems, new people to be hired, etc. All of these potential costs (and synergies / new opportunities) need to be in the model.

Finalize Deal Structure and Financing

- What: This is the finalization of the terms of the deal and the arrangement of necessary financing. Not much should change from the LOI, but things always "move around" a bit, and the purchase price may change as things are uncovered during diligence.

- Why: The structure and financing of the deal can influence its profitability and success.

- Financial Model Impact: The finalized deal structure and cost of financing will be reflected in the financial model, affecting valuation and projected returns. Once again, everything in your model needs to tie out exactly to everyone's latest understanding, and you absolutely need double-checks to ensure accuracy.

Close the Deal

- What: This is the final step where all legal documents are signed and the deal is officially completed. It's usually a hectic week that finishes off with a very late night wrapping-up all the last minute details.

- Why: Deal closure signifies the successful completion of the acquisition process.

- Financial Model Impact: At this point, the financial model will have informed the final terms of the deal and be used as a basis for post-acquisition financial planning and performance tracking. However, you will likely be building a separate "Funds Flow" document that shows the exact dollar amounts (along with wiring information) to formally finance the deal.

Conclusion

This email was gigantic, so thanks for reading.

It maps out the big picture of how a company is acquired, and how it affects your model along the way.

Save this, as a "due diligence playbook" was something that was always in high demand during my PE days.

Remember, going forward we're blending Private Equity and FP&A together, because they are so intertwined.

Until next time. —Chris