Introduction:

Accounts Receivable (AR) modeling is a vital cog in the financial modeling machinery, playing a significant role in managing cash flows and forecasting revenue. In this comprehensive guide, we'll focus on two widely-used AR modeling methods: the Classic DSO method and the Collections Delay method.

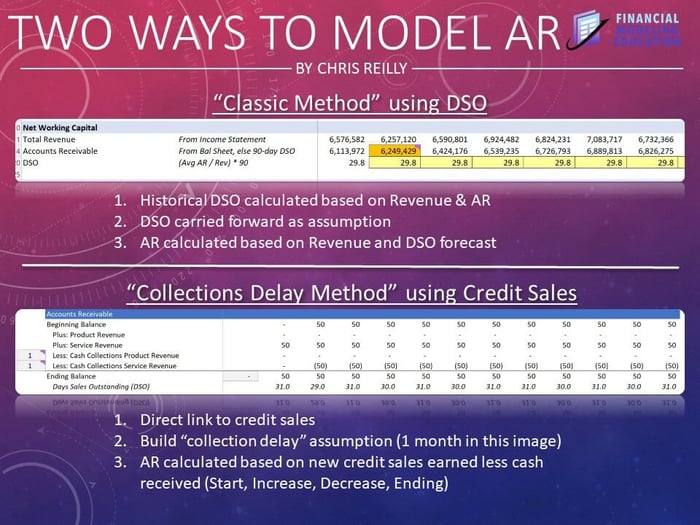

The Classic DSO Method:

What is it?

The Classic DSO method is a tried-and-true AR modeling technique with broad acceptance across various industries.

Steps:

- Refer to Historical Revenue and AR Balance

- Carry Forward the DSO Assumption

- Calculate the New AR Balance

The simplicity and adaptability of the Classic DSO method make it an attractive choice, particularly when Profit & Loss (P&L) information is limited.

Pros and Cons of the Classic DSO Method

Pros

- Simplicity: This method is straightforward and easy to understand, making it accessible for beginners.

- Less Data Required: It doesn't require granular data, making it suitable when detailed sales and collections data are unavailable.

Cons

- Less Detailed: This method might oversimplify reality by assuming a constant DSO.

- Less Predictive: Changes in payment terms or collection effectiveness may not be captured if the DSO is held constant.

The Collections Delay Method:

What is it?

The Collections Delay method is an alternate AR modeling technique focusing on the delay in collections.

Steps:

- Direct Link to Credit Sales

- Model a Collections Delay Assumption

- Calculate AR Balance

The Collections Delay method is audit-friendly and can provide a granular look at cash inflow, but it requires detailed sales and collections data.

Pros and Cons of the Collections Delay Method

Pros

- Detailed: It provides a granular view of the collections process.

- Flexible: It can better capture changes in payment terms or collection effectiveness.

Cons

- Data Intensive: It requires detailed credit sales and cash collections data.

- Complex: It can be more complex to set up and maintain, particularly for large firms with diverse customer bases.

Linking AR Modeling to Other Financial Metrics

Understanding AR modeling also opens the door to comprehending its impacts on other key financial metrics:

-

Cash Flow: AR represents money that has been earned but not yet received. Changes in AR balances directly impact cash flows, with increases in AR reducing cash flow and decreases in AR increasing cash flow, all else being equal.

-

Working Capital: AR is a critical component of working capital (Current Assets - Current Liabilities). Larger AR balances increase working capital, which might indicate potential liquidity issues if cash is not being collected promptly.

-

Financial Ratios: AR also affects various financial ratios. For instance, Days Sales Outstanding (DSO) is a liquidity metric that illustrates how long it takes a company to collect revenue after a sale has been made.

Conclusion:

The Classic DSO and Collections Delay methods each bring a unique lens to AR modeling. While the Classic DSO method is versatile and simple, making it a go-to choice when data is limited, the Collections Delay method can offer a more detailed view of cash inflows when the necessary data is available.

Next Steps:

If and when the time is right, I offer advanced Financial Modeling courses tailored for FP&A and Private Equity professionals who want to take their modeling skills to the highest level. Go beyond Excel, and become an expert financial modeler today.