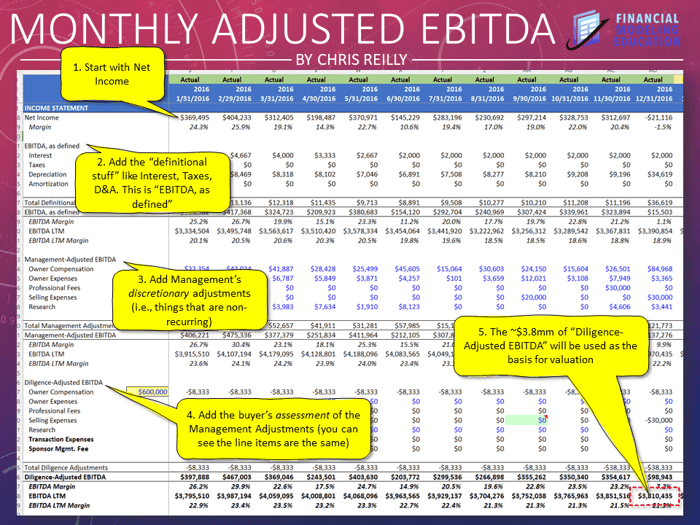

Start With Net Income

Net Income serves as our foundational figure, but since it doesn't equate to cash, adjustments are needed. It's essential to understand that Net Income includes various non-cash expenses, such as depreciation and amortization, that must be added back to depict a truer picture of a company's operating cash flow and profitability.

Let's Get on the Same Page

EBITDA, as Defined

The journey toward Adjusted EBITDA begins with what's referred to as "EBITDA, as Defined." This term means we're talking about:

- Earnings: Essentially, Net Income.

- Interest: This accounts for the cost of borrowing.

- Taxes: A necessary part of any business, these are added back to focus on operations.

- Depreciation & Amortization: Non-cash charges related to the wear and tear of assets.

At Your Discretion

Management's Perspective

Management will take EBITDA, as Defined, and propose discretionary one-time adjustments. This step can include:

- Owner Compensation

- Owner Expenses

- Professional Fees

- Selling Expenses

- Research

This results in "Management-Adjusted EBITDA," providing a normalized view of earnings.

But Can You Defend It?

The Diligence Side

The prospective buyer analyzes the adjustments proposed by Management. They may agree or disagree, leading to "diligence adjustments." Buyers might add extras that kick in once the deal closes. This leads to "Diligence-Adjusted EBITDA," used for valuation.

Why So Many Steps?

The process may seem cumbersome, but it serves a crucial purpose. By starting with Net Income and seeing one adjustment at a time, we create a defensible trail to Diligence-Adjusted EBITDA. It's about clarity and transparency in the figures.

Making it Fit into Your Financial Model

Another advantage? This method fits seamlessly into a financial model, enhancing the ease of analysis and understanding.

Conclusion

Understanding Adjusted EBITDA in Quality of Earnings can be straightforward if approached systematically. The step-by-step guide above helps demystify the process and reveals how financial professionals reach a critical figure in business valuation.

Looking to deepen your understanding of Financial Modeling? Consider enrolling in my Financial Modeling Courses. I've crafted them to help professionals like you master complex topics in a relatable way. Click here to learn more.