An easy way to forecast capex ↓

Here's my favorite part about the budgeting process:

It's late October... Revenue and EBITDA look good,

you're about to hit submit, and then from the shadows someone yells,

"𝙬𝙖𝙞𝙩, 𝙬𝙝𝙖𝙩 𝙖𝙗𝙤𝙪𝙩 𝙘𝙖𝙥𝙚𝙭?"

Everyone looks around and then the "ohhhhh whoops" feeling sets in.

We forgot capex. Completely.

Why? It's not part of the P&L so it often gets overlooked until the end.

The truth is —

𝗖𝗮𝗽𝗶𝘁𝗮𝗹 𝗘𝘅𝗽𝗲𝗻𝗱𝗶𝘁𝘂𝗿𝗲𝘀 𝗼𝗿 "𝗖𝗮𝗽𝗲𝘅" 𝗶𝘀 𝗶𝘁'𝘀 𝗼𝘄𝗻 𝘀𝗲𝗽𝗮𝗿𝗮𝘁𝗲 𝗯𝘂𝗱𝗴𝗲𝘁.

It just happens to hit the Balance Sheet (& therefore Cash Flow Statement) instead of the P&L.

———

There's good news, however — it's actually a fairly easy process.

But first, what is "capex"?

"𝗖𝗮𝗽𝗲𝘅" 𝗶𝘀 𝗰𝗮𝘀𝗵 𝘄𝗲 𝘀𝗽𝗲𝗻𝗱 𝘁𝗼𝗱𝗮𝘆 (𝘁𝗼 𝗮𝗰𝗾𝘂𝗶𝗿𝗲 𝗮𝗻 𝗮𝘀𝘀𝗲𝘁) 𝘁𝗵𝗮𝘁 𝗯𝗲𝗻𝗲𝗳𝗶𝘁𝘀 𝘂𝘀 𝗶𝗻 𝘁𝗵𝗲 𝗳𝘂𝘁𝘂𝗿𝗲.

We depreciate the 𝗰𝗼𝘀𝘁 in the future to satisfy the "matching principle"

Why depreciate?

Well if I buy a delivery truck, that truck will help me generate Revenue over the next [7] years or so (by making deliveries).

So, I need to "match" its cost against the Revenue it helps me generate.

———

So with that in mind, here's how we can build it:

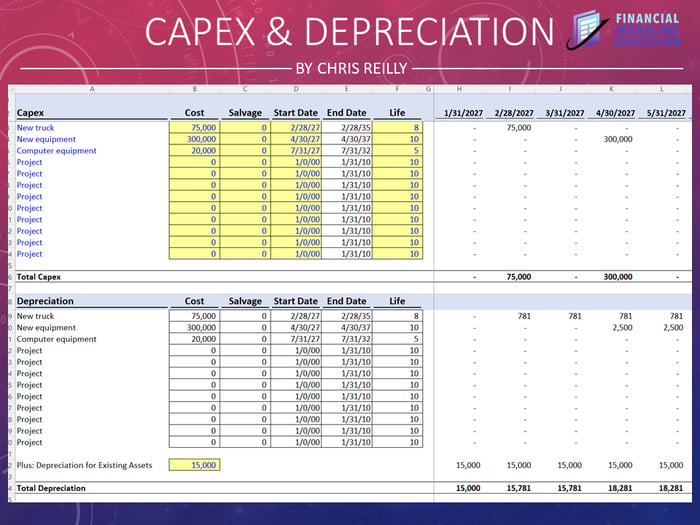

Take a look at the image above...

I've got two identical sections (in terms of layout) that do slightly different things.

The first is the "capex" section, and this is where I list the actual project and what it will cost.

So the very first entry, I'm saying, "I'd like to buy a $75,000 truck in February of 2027 and I think it will last me 8 years (the "useful life")."

And you can see over to the right the 𝗰𝗮𝘀𝗵 𝗶𝗺𝗽𝗮𝗰𝘁 -- $75,000 goes out in February of 2027.

Now, the second section:

You can see that same new truck is listed at the top, but over to the right it's different...

In February 2027 you see $781 that continues monthly.

That is the 𝗱𝗲𝗽𝗿𝗲𝗰𝗶𝗮𝘁𝗶𝗼𝗻 = $75,000 / 8 years / 12 months = $781 per month.

Effectively, the depreciation makes an accounting adjustment to my cash cost so that the expense of the asset 𝙢𝙖𝙩𝙘𝙝𝙚𝙨 the Revenue it helps create.

———

From there, it's just a link-up to my 3 Statement Model:

✅ (1) the Capex links to the Fixed Asset account like this:

◼️ Prior Period balance 𝘱𝘭𝘶𝘴 the new Capex

(if done correctly, this will let me see the $75,000 in the Cash Flow Statement)

✅ (2) the Depreciation links to my Income Statement, and;

✅ (3) it gets captured on my Balance Sheet in Accumulated Depreciation

◼️ Prior Period balance 𝘱𝘭𝘶𝘴 the new Depreciation

(if done correctly, this will zero out any "cash impact" of Depreciation in my Cash Flow Statement)

The net impact of it all?

I'm showing the cash out the door today, but also have the correct accounting treatment of depreciating the cost in the future 👍

—Chris

p.s. if you liked this post, please consider joining my free email series the Financial Modeling Educator, where I go in-depth on Financial Modeling for Private Equity and FP&A Professionals.