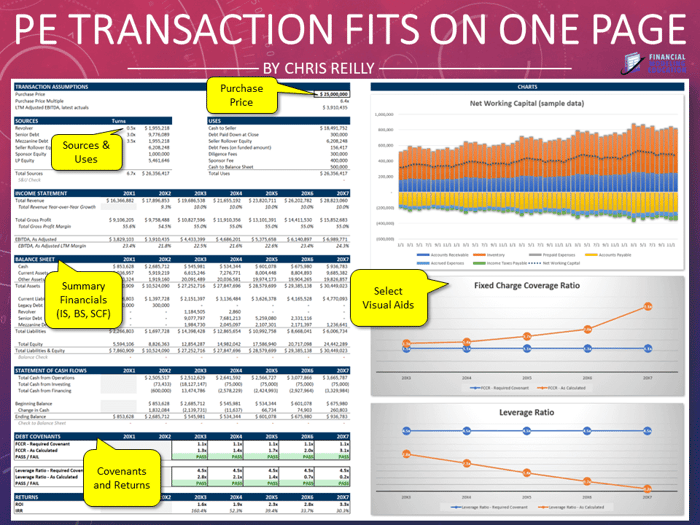

Here's how I fit a private equity transaction on one page.

This is an example of what you would show a Managing Partner before moving forward with a deal.

The Layout

Transaction Assumptions

Hits on the big items like purchase price, EBITDA, and EBITDA multiples.

Sources & Uses

How are we going to pay for the deal? This shows the debt and equity required, as well as where the funds are going to go: pay the seller, show any seller rollover, deal fees, and cash to the balance sheet.

Summary Income Statement

We're just talking "big picture" here, so we've got things like Revenue, Margin, and EBITDA. That's it.

Summary Balance Sheet

Again, big items: Cash, Debt, Equity, and any other material items that the partner wants to know.

Summary Statement of Cash Flows

A highlight of the three main sections: Operating, Investing, Financing, as well as the Change in Cash and Ending Cash.

(Note: make sure ending cash in your Statement of Cash Flows matches the Balance Sheet!)

Covenants

Will we be in compliance on our debt? I need this metric to be extremely clear and easy to find because we need to raise debt in order to get this deal done, and covenant compliance is at the core of this exercise.

Returns

Lastly, we're doing all this to make a return on the equity investment so we can (a) generate a great return for our investors and (b) participate in caried interest.

Charts

Visual metrics that are typically "audience-requested." I like to start with working capital and covenants, but I will adjust these as needed based on requests.

(Note: the Working Capital graph is just sample data in this example and not hooked up to the underlying model)

The Details

Below this one-pager is a much more detailed monthly LBO Model, and this is why I preach modeling in one place, but printing in another.

It makes the summary easy -- I just pull information from my detailed model that I already trust, as opposed to trying to confine my model to a print-friendly format.

Coupled with a list of underlying assumptions (another page you can build), this is something you would send to your team or Managing Partner along with your recommendation on whether or not to move forward with a deal.

The One-Pager About Me:

I spent the majority of my career in middle-market private equity, and today I'm fortunate enough to teach financial modeling to people around the world (building models was always my favorite part of the job).

My work has been featured with Wall Street Prep, The Wharton Online Private Equity Certificate Program, LinkedIn Learning, FTI Consulting, and more.

So if you'd like to learn more about advanced financial modeling for Private Equity and FP&A, then please consider joining my free email series the Financial Modeling Educator.

Written in a down-to-earth and relatable style, I "brain dump" everything I've ever known about financial modeling to help improve your skills.

You can sign up for free here.