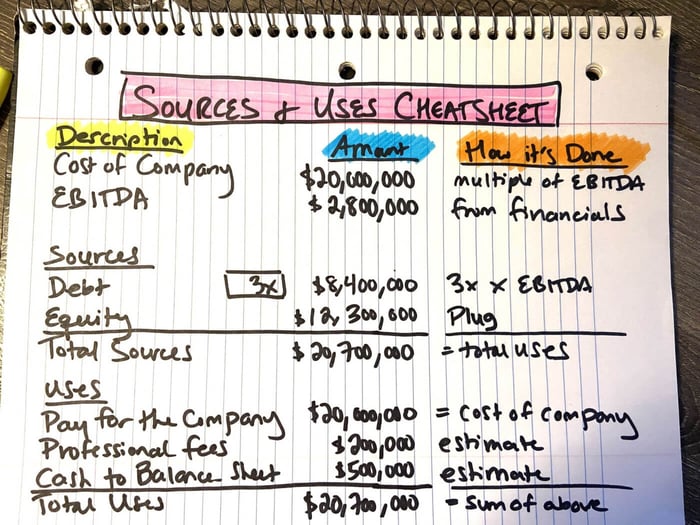

A 𝗰𝗵𝗲𝗮𝘁 𝘀𝗵𝗲𝗲𝘁 for the Sources & Uses ↓

Step 1: value the company (usually a multiple of EBITDA).

Step 2: pull EBITDA from the financials

Step 3: The "cost of company" goes to the uses

Step 4: estimate any professional fees

Step 5: estimate any cash needed for the balance sheet

Step 6: sum up the uses

Step 7: make Total Sources equal Total Uses

Step 8: Calculate the maximum leverage (usually governed as a multiple of EBITDA)

Step 9: plug the equity (this is how much is "leftover" so that the total sources equal the total uses)

Note: the deal gets "more expensive" from an equity perspective as your leverage multiple goes down (sources) and your fees & expenses go up (uses)

Stop plugging Retained Earnings (I've been there) and learn to build models the right way: CLICK HERE TO READ MORE...