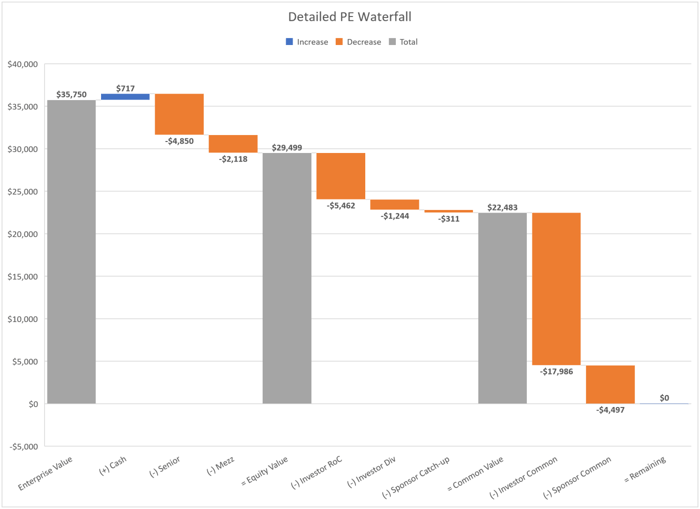

How to model a private equity waterfall. I see this modeled incorrectly all the time.

Enterprise Value or "EV"

aka the price/value of the company for sale.

Typically calculated using the last-twelve-months (LTM) EBITDA multiplied by a "market multiple"

(in this example, it was $5.5m x 6.5x (not shown) = ~$35.75m Enterprise Value)

(+) Cash:

We add the Cash to the EV b/c the Seller gets to keep any cash at closing.

Why? Cash reflects value the Seller has created in the past.

So, it's theirs to keep (not the new buyer's).

(-) Senior:

Now we start to pay down debt.

Just like the value of a house, your "equity" is what's leftover after you pay the mortgage.

In this waterfall, the Senior Debt has "priority" so it is paid down 1st.

(-) Mezz:

"Mezz" is short for "Mezzanine" — another type of debt.

In this waterfall, the Mezz is "junior" to the Senior Debt, so it is paid down 2nd.

= Equity Value:

All of our debt obligations have been paid off, so now we have "Equity Value," or what's available to be distributed to all equity holders.

(-) Investor ROC:

"RoC" is an abbreviation for "Return of Capital."

Often times certain investors in the deal will hold "Preferred Equity."

All this means is these investors are paid out first before any Common proceeds (but after debt).

(-) Investor Div:

This is a "dividend" that is often associated with holding "Preferred Equity."

Not only do these investors get their capital out first (above), they also get something called a "Preferred Dividend" on top of their investment.

This is often called the "hurdle" b/c it must be "cleared" before proceeds go to Common.

(-) Sponsor Catch-up

Now that the investor has received all their capital plus a preferred dividend, it's time for the PE firm to get their share, or "catch-up" to what has already been distributed.

In an 80/20 split, the investor dividend (up to this point) equals 80% of the proceeds so far, and the "catch-up" is the other 20%.

= Common Value:

Finally, we've reached the Common Shareholders.

This is everything that is leftover after all our obligations have been paid off.

Under this deal, the remaining proceeds get split 80/20 to Investors/PE firm.

**Double-check: investors should get 80% of gain, PE firm should get 20% of gain (assuming the full waterfall has been paid out)

Trade-offs:

Typically, the Senior Debt receives the lowest return because it has the least amount of risk in the "capital stack," and is therefore paid out first.

The Mezz has a higher interest rate (higher return) because it gets paid out in the middle.

From there, you work your way down to Common, which can create the highest returns but also carries the most risk, since it is paid out last.

Join us!

If you found this post even remotely interesting, please consider joining my free email series the Financial Modeling Educator.

I brain dump pretty much everything I've ever known about Financial Modeling, Private Equity, and FP&A.

You can sign-up here.