Ever wonder how EBITDA changes in an M&A transaction (pre- and post-close)? This post walks through the differences...

EBITDA, as Defined

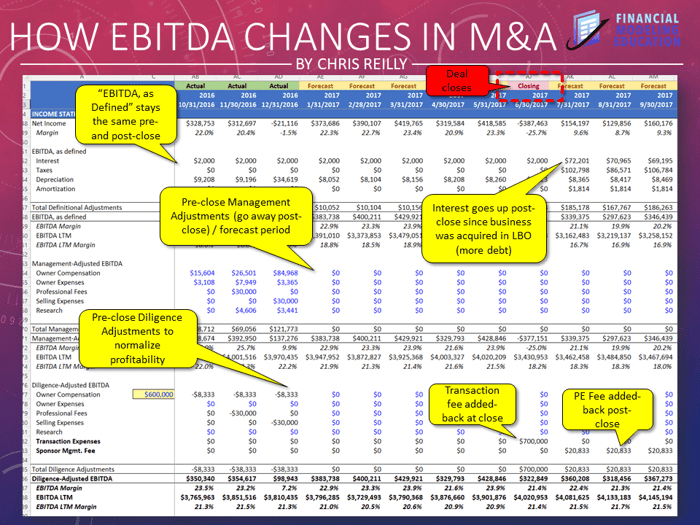

This stays the same pre- and post-close because it is the literal definition of EBITDA: Earnings (Net Income) before Interest, Tax, Depreciation, Amortization.

This is basically the EBITDA we all (should) agree on.

Management-Adjusted EBITDA

The discretionary adjustments proposed by management pre-close. These typically go away post-close because they should be one-time in nature and won't be incurred going forward.

In a perfect world, all historical adjustments would be addressed on a go-forward or "pro forma" basis in the P&L, and therefore wouldn't require any "add-backs."

As a result, the forecast shows zeroes. They should only be reflected in the history (Actuals).

Diligence-Adjusted EBITDA

Contains pre-closing adjustments made by the PE team based on its review of the Management adjustments and other things discovered during diligence (and detailed in a QofE).

From a modeling perspective, this is a great place to reverse, back out, or modify any Management Adjustments the PE firm doesn't find reasonable or thinks should change.

You're simply creating a negative (or some kind of offset) of a particular Management Adjustment and labeling it as such, as opposed to having to delete something from the Management-Adjusted section.

Post-close, it includes the Transaction Fees as well as the Private Equity Management Fee, since it will be non-recurring once the PE firm exits the company.

Note: the "management fee" sometimes comes up for debate with lenders, but typically the "ask" is to include the management fee in the EBITDA calculation and negotiate from there.

Zoom Out:

Pre-close, both buyer and seller are trying to adjust EBITDA to arrive at a normalized profitability so everyone can agree on a basis for valuation.

Post-close, the EBITDA (should be) cleaner to only reflect regular definitional adjustments plus anything directly as a result of the transaction (because it was all ironed out in diligence).

In reality, it's common to still see management adjustments as the team accounts for one-off items that might be non-recurring going forward. However, the forecast should still always be zero for management, but you may see some new ones show up in the actuals.

Let's take this offline...?

If you found this post interesting, then please consider subscribing to my free email series the Financial Modeling Educator, where I go in-depth on Financial Modeling and how it intersects with the world of Private Equity and FP&A.

You can sign-up for free here.