In a previous post, I introduced the concept of the 'Revolver Schedule' in financial modeling. If you recall, a Revolver is a term we use to describe a large line of credit, like a giant credit card for your business. Today, we're going deeper into this topic.

Understanding the Revolver Schedule

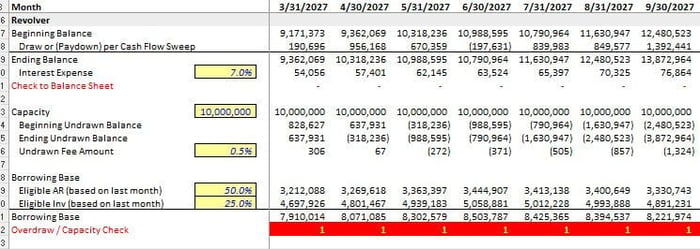

The core function of the Revolver Schedule is to manage your cash flows. If the business is running low on cash, you can 'draw' on the Revolver, just like borrowing from a credit card. Similarly, if the business has excess cash, you can pay down the Revolver. But, remember, just like a credit card, the Revolver has a 'capacity.' You can't borrow more than a certain limit.

What Happens When You Exceed the Revolver Capacity?

Technically, the cash in the business should go negative. However, let's keep in mind that "the model is an abstract representation of the business to help us make decisions," and NOT the business itself.

Allowing the Revolver to Draw: A Strategic Decision

Contrarily, if we just "let the model run" and allow the Revolver to "draw" (borrow) whatever it needs to, we glean some valuable insights. It alerts us if we are about to exceed our Revolver capacity, thus prompting us to take action, like reforecasting our projections, requesting a larger Revolver, or both. This ability to foresee potential financial crunches is one of the main benefits of our model.

Facilitating Proactive Conversations and Decisions

For instance, imagine a conversation with your boss or team. If the model indicates that you're exceeding the Revolver's capacity, you can proactively discuss the necessary actions. It's much clearer than going back and forth over why the cash is going negative and by how much.

The True Value of a Good Financial Model

In essence, a good financial model provides just the right amount of accuracy to facilitate decision-making. It doesn't have to be perfect or intricate; it just has to effectively aid us in navigating our business landscape.

Building checks or indicators around major business issues, such as exceeding the Revolver's capacity, ensures that the model can provide valuable insights and foster strategic discussions. Remember, the true value of a model is not in its aesthetic appeal or perfection, but in the strategic conversations and informed decisions it inspires.

Level Up Your Financial Modeling Skills

As a final note, I offer comprehensive Financial Modeling Courses designed to equip FP&A and Private Equity Professionals with practical skills. If you're interested in taking your financial modeling skills to the next level, don't hesitate to check them out.