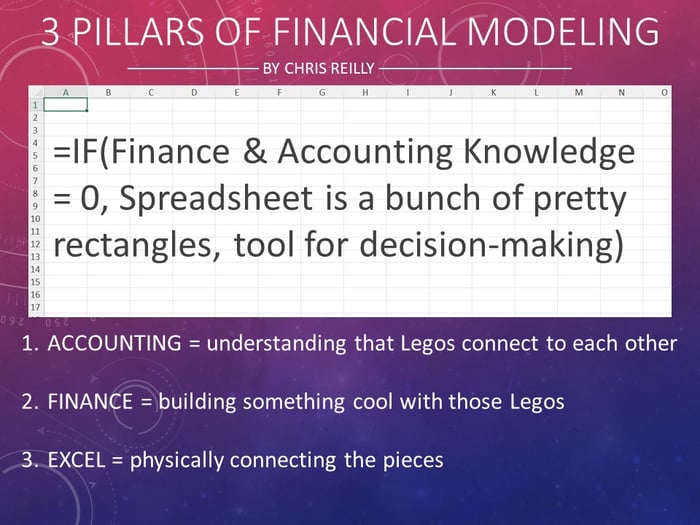

Financial modeling skills are more than just proficiency in Excel. They comprise a nuanced understanding of Accounting, Finance, and effective tool use. In this post, we will go beyond Excel and delve into these key aspects that are crucial for enhancing your financial modeling skills.

Accounting: The Building Blocks of Financial Modeling

Accounting can be thought of as the foundation for financial modeling. The first step is understanding how the pieces fit together, just like building with Legos.

To accurately forecast the future (Finance), we need a comprehensive understanding of the past (Accounting). Familiarize yourself with core accounting concepts like Double-Entry Bookkeeping, Revenue Recognition, Accrual Accounting, and more.

The skill to integrate the three financial statements from an accounting perspective can be the most valuable asset in your financial modeling skills repertoire. A sturdy foundation leads to a strong structure.

Finance: The Blueprint of Financial Modeling

Once we've got the building blocks, it's time to look at the blueprint, which in our case is Finance. This involves making estimates about the future and translating those estimates into the language of accounting.

Key concepts to understand include the Risk and Return Trade-off, Cash Flow Management, Time Value of Money, Capital Budgeting, Capital Structure, Financial Ratios, Cost of Capital, and Leverage.

Just as a good blueprint leads to a successful build, a deep understanding of these finance concepts can significantly enhance your financial modeling skills.

Excel: The Tool for Financial Modeling

Excel is the tool we use to assemble our blocks according to the blueprint. While Excel is an indispensable tool, it's just a means to an end, a platform to compile your Accounting & Finance knowledge into a usable format.

Whether you use XLOOKUP, INDEX/MATCH, or VLOOKUP doesn't really matter in the grand scheme of things. It's your understanding of Accounting and Finance that truly sets your models apart.

Conclusion: The Essential Trio for Financial Modeling Mastery

Mastering financial modeling skills means understanding that it's not just about Excel. It's about understanding the building blocks (Accounting), following the right blueprint (Finance), and using the correct tool (Excel) effectively.

By mastering the 80/20 of core Accounting and Finance principles, you can significantly improve your financial modeling skills, focusing on what truly matters instead of overcomplicating things.

Ready to take your financial modeling skills to the next level? Explore my in-depth financial modeling courses designed specifically for FP&A and Private Equity Professionals. Elevate your expertise and stay ahead in your career.