SaaS Modeling: GRR vs NRR

Today we're going to dive into the world of SaaS Metrics, and start off with something relatively simple:

Gross Revenue Retention (or "GRR") and Net Revenue Retention (or "NRR").

|

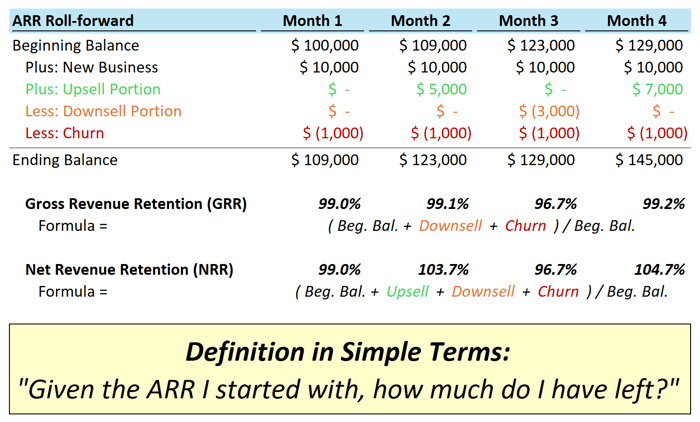

These are two calculations that help us figure out "what percent of our ARR is remaining after a given time period?"

Let's get started...

Refresher: What is ARR?

A quick refresher... what is ARR?

Simple example: If one customer pays $500 per month, their ARR is $500 × 12 = $6,000.

Understanding Retention

Once SaaS companies have calculated their ARR, next they want to know, "well, how much ARR did we keep?"

This is important because companies (and investors) need a sense of how many customers actually stick around.

After all, it's only "recurring" if they stay, right?

That's where GRR and NRR come in...

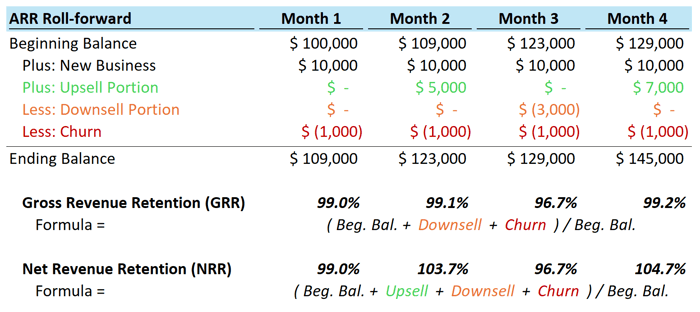

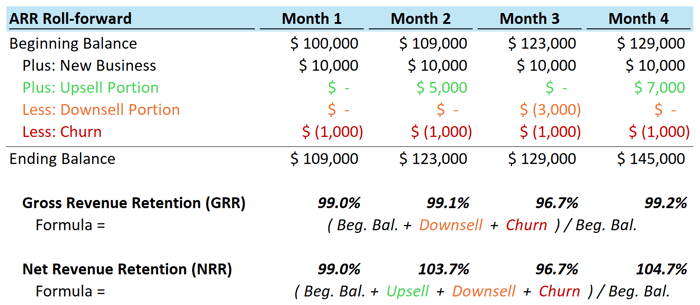

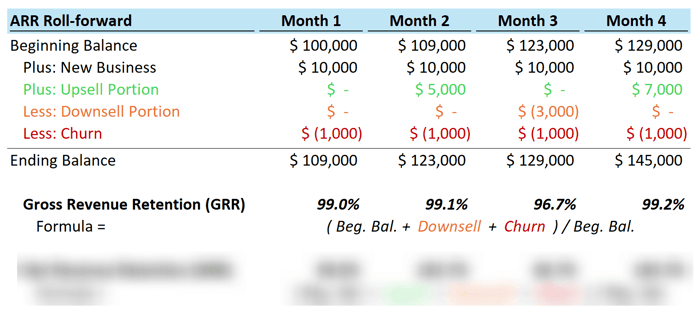

Calculating Gross Revenue Retention (GRR)

Let's look at GRR first.

GRR is the "scarier" of the two metrics because it doesn't factor in any "Upsells," which is incremental revenue from existing customers.

In other words, it excludes customers that have expanded their plans.

|

So in the image above, the calculation for Month 3 is:

GRR = ($123,000 - $3,000 - $1,000) / $123,000

GRR = $119,000 / $123,000

GRR = 96.7%

Since GRR doesn't include Upsells, it can never go above 100%.

And said in simple terms: "Of the $123,000 of ARR that we started with, we retained 96.7% on a gross basis."

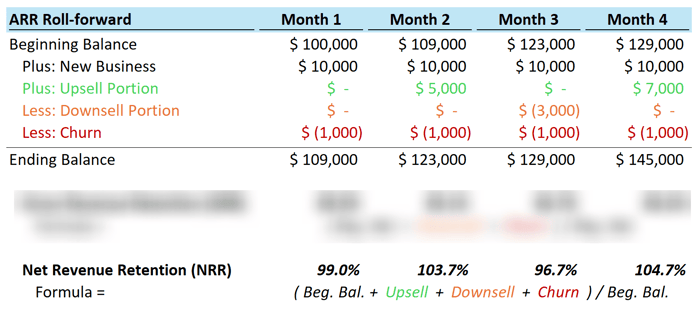

Calculating Net Revenue Retention (NRR)

Now let's look at NRR.

Basically the same calculation as GRR, except NRR includes Upsells:

Do you subscribe to something in your personal life? Probably.

Think of an "Upsell" like upgrading from "Basic" to "Pro."

You're an existing customer, but you want more out of the service.

|

So in the image above, the calculation for Month 2 is:

NRR = ($109,000 + $5,000 - $1,000) / $109,000

NRR = $113,000 / $109,000

NRR = 103.7%

Since NRR includes Upsells, it can exceed 100%.

And said in simple terms: "Of the $109,000 of ARR that we started with, we retained 103.7% on a net basis."

In other words, the business expanded more than it contracted.

Often times, NRR is the more important metric for investors, but both are relevant.

GRR and NRR Together

Here are the two metrics side-by-side, giving full context to the numbers:

|

Conclusion: GRR and NRR

Big picture, the company is trying to figure out how much revenue is retained.

Because if tons of people are cancelling each month, that's not a great sign.

GRR is a bit "harsher" (how many customers stay without incremental sales).

Alternatively, NRR helps you understand overall growth including extra sales.

Both should be calculated alongside ARR in your financial model.

That's it for today. See you next time.

—Chris

p.s., if you enjoyed this post, then please consider checking out my Financial Modeling Courses. As featured by Wharton Online, Wall Street Prep, and LinkedIn Learning, you'll learn to build the exact models I use with Investment Banks, FP&A Teams, and Private Equity Firms 👉 Click here to learn more.