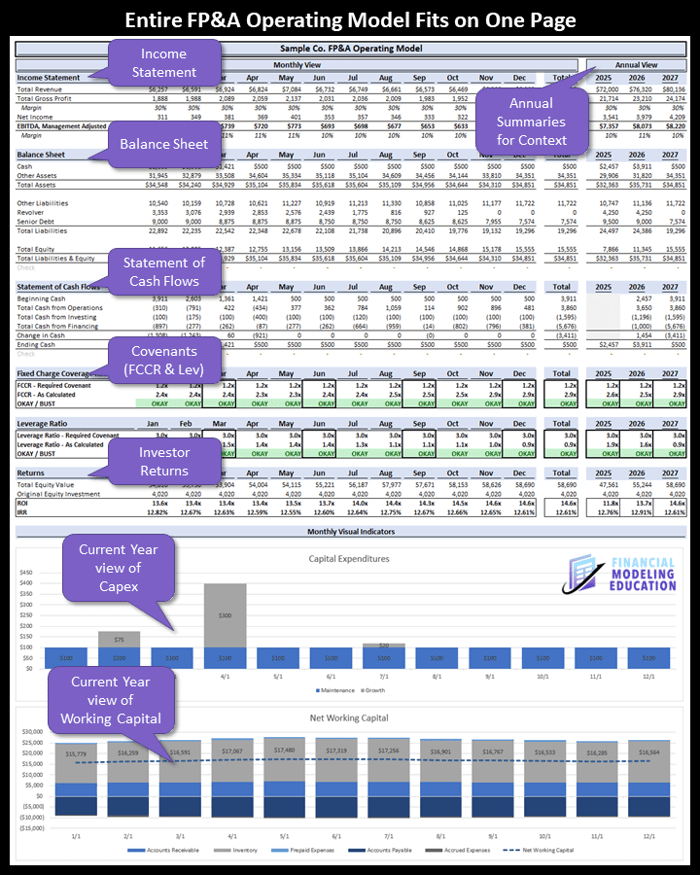

𝗣𝘂𝗿𝗽𝗼𝘀𝗲 𝗼𝗳 𝗢𝗻𝗲-𝗣𝗮𝗴𝗲𝗿

Creating a one-page FP&A Operating Model is akin to distilling a complex symphony into a single sheet of music. It's about bringing the essential notes and rhythm to the fore and providing clarity without losing complexity.

Here's why it's more than just a concise presentation:

Income Statement

- Revenue, Gross Profit, Net Income, EBITDA: The heart of the business, these metrics capture the performance at a glance. They are often the go-to figures for investors, analysts, and executives. By focusing on these, the one-pager gives a snapshot of where the money is coming from and where it's going.

Balance Sheet

- Cash and Debt Balances: The liquidity and leverage of the company can be understood through these key figures. Being the "must know" items, they paint a picture of the financial stability of the company.

Statement of Cash Flows

- Summarizing the three sections (Operating, Investing, Financing), and ending cash: Cash flow is the lifeblood of a business. This summary provides insights into the company's ability to generate cash and how it is utilized, creating a bridge between the Income Statement and Balance Sheet.

Covenants

- Compliance checks such as Fixed Charge Coverage Ratio (FCCR) and Leverage Ratio: These ensure that a company is adhering to its contractual obligations. Monitoring them is vital to avoid any legal hiccups and maintain a good standing with lenders.

Returns

- Investor's gains, Equity Value, ROI, IRR: These figures matter to the stakeholders. They provide insights into how their investments are performing and the potential financial rewards they can expect.

Visual Aids

- Break down Capital Spend, Net Working Capital, etc.: Visualizing these components helps in quick interpretation and adds layers to the understanding of the company's operations. They can be tailored according to the audience's needs.

Why A One-Pager?

A one-pager serves multiple purposes:

- Quick Overview: Perfect for stakeholders who need a swift understanding.

- Focus on Essentials: It emphasizes key metrics, avoiding data overload.

- Versatile Communication Tool: Easily shared in an email, printed, or presented in meetings.

Practical Application

Whether you're an FP&A professional dissecting the company's operations or a private equity expert analyzing potential investments, the one-pager is a tool that can be customized and adjusted according to the KPIs you want to highlight.

It's about understanding the financial landscape from a bird's-eye view, yet having the ability to zoom in when needed.

Conclusion

The FP&A Operating Model's one-pager is an invaluable asset in the toolkit of any financial professional. It simplifies without dumbing down, clarifies without omitting, and presents without overwhelming.

Ready to upgrade your skills? Be sure to check out my Financial Modeling Courses and take your Financial Modeling skills to the highest level.