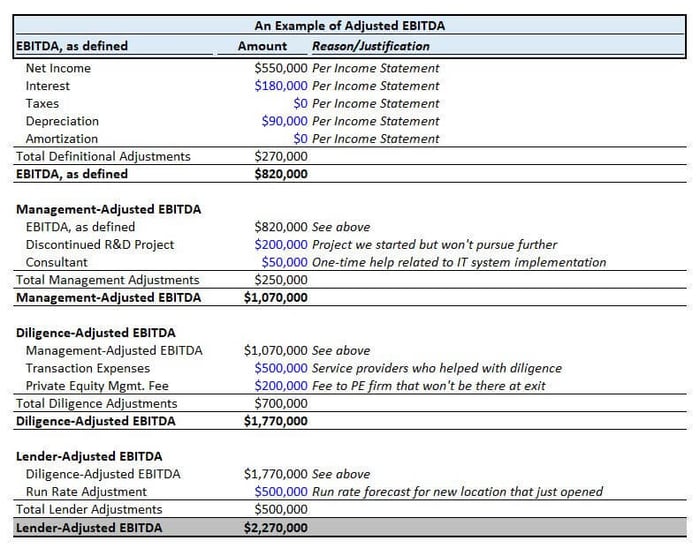

Here's what an Adjusted EBITDA schedule looks like:

First though -- what are we building here?

Adj EBITDA = an APPROXIMATION of the free cash flow of a business.

Where does it immediately fall short?

It excludes Capex (like buying machinery & equipment)

(↑ topic for another day)

———

Working from the top:

(1) Start with Net Income b/c that's our "bottom line"

Then we build our way back up with "Definitional" Adjustments first

"Definitional" just means the literal items in the word "EBITDA"

So that would be "Interest, Taxes, Depreciation, & Amortization"

= this gives us "EBITDA, as defined," or said another way, "the EBITDA we can all actually agree on."

———

(2) Then we start getting creative, part 2 is the Management Adjustments

This is Management saying "here are one-time things we did that won't continue in the future"

The key point here is these are 𝘥𝘪𝘴𝘤𝘳𝘦𝘵𝘪𝘰𝘯𝘢𝘳𝘺.

You can see Management adjusted or "added-back" the cost of an R&D project that didn't pan out and a Consultant that helped put in a new IT system.

= so now we've got "Management Adjusted EBITDA" which is the "EBITDA, as defined" plus discretionary adjustments from the management team.

———

(3) Keep going, now we get to the PE Firm.

To buy the business, they had to hire service providers to help with diligence, think: accounting firms, background checks, environmental surveys, etc.

The PE firm also takes a "management fee" that effectively compensates the PE firm for its time spent helping the company grow.

Neither of these expenses will exist going forward (the transaction fees are one-time in nature, and the management fee goes away when the PE firm sells ("exits") the business)

= now we've got "Diligence Adjusted EBITDA" which is:

- EBITDA as defined, plus

- Management Adjusted EBITDA, plus

- the PE firm adjustments

———

(4) Last step, now we're getting to "Lender Adjusted EBITDA"

Let's say we just opened a brand new location...

We might only have a few months of "operating history", but we know the new location is going to do well in the future.

We might ask the lender for some "run rate / pro forma credit" that illustrates what we expect the new location to do over the next several months.

We want this b/c the lender uses our EBITDA to measure our covenants.

So we add them all together:

- Definitional, plus

- Management Adjustments, plus

- Diligence Adjustments, plus

- Lender Adjustments

= Lender Adjusted EBITDA (the true "bottom line")

———

It might start to seem a little "hocus pocus" after a while, but so long as you 𝗽𝗿𝗼𝘃𝗶𝗱𝗲 𝗮 𝘁𝗵𝗼𝘂𝗴𝗵𝘁𝗳𝘂𝗹 𝗲𝘅𝗽𝗹𝗮𝗻𝗮𝘁𝗶𝗼𝗻 for your adjustments, it's reasonable to include them.

It only starts getting out of control when there are tons of small one-off adjustments -- more a sign of poor budgeting than accurate EBITDA.

—Chris

p.s. if you liked this post, consider joining the Financial Modeling Educator, my free email series that goes in-depth on Financial Modeling for FP&A and Private Equity professionals to help make you a better Financial Modeler.