How does someone make money in private equity?

I mean beyond base salary anyway?

The primary upside for someone in Private Equity is called "carried interest,"

which is really just "splitting some of the profits."

———

Remember, PE firms raise money from outside partners often called "LPs."

(𝘓𝘗 𝘴𝘵𝘢𝘯𝘥𝘴 𝘧𝘰𝘳 "𝘓𝘪𝘮𝘪𝘵𝘦𝘥 𝘗𝘢𝘳𝘵𝘯𝘦𝘳")

The "LP Money" is used to purchase companies (alongside debt).

When a company is sold, the PE firm returns the original money to the LPs.

(𝘓𝘗𝘴 𝘨𝘦𝘵 𝘵𝘩𝘦𝘪𝘳 𝘮𝘰𝘯𝘦𝘺 𝘣𝘢𝘤𝘬 𝘫𝘶𝘴𝘵 𝘭𝘪𝘬𝘦 𝘪𝘧 𝘺𝘰𝘶 𝘭𝘰𝘢𝘯𝘦𝘥 𝘢 𝘧𝘳𝘪𝘦𝘯𝘥 $20, 𝘩𝘰𝘱𝘦𝘧𝘶𝘭𝘭𝘺)

———

But here's where the "carried interest" or "profit splitting" comes in...

Once the PE firm has returned all the LP Capital,

(+ 𝘴𝘰𝘮𝘦𝘵𝘩𝘪𝘯𝘨 𝘰𝘯 𝘵𝘰𝘱 𝘶𝘴𝘶𝘢𝘭𝘭𝘺 𝘤𝘢𝘭𝘭𝘦𝘥 𝘢 "𝘱𝘳𝘦𝘧𝘦𝘳𝘳𝘦𝘥 𝘥𝘪𝘷𝘪𝘥𝘦𝘯𝘥")

then the PE firm is eligible to participate in the "carry," and all remaining profits are usually split 80/20.

80% goes to the LPs, 20% goes to the PE firm.

The 20% is designed to compensate the PE firm for all the work they put into the deal.

———

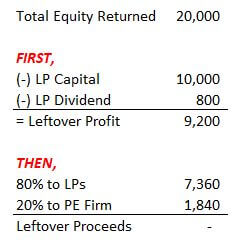

Take a look at the "waterfall image" below...

Let's say a company sold and it returned $20 million of equity, of which $10 million was raised from LPs.

▪️ First, the LPs get their $10 million back,

▪️ plus a "preferred dividend" of $800k.

(𝘣𝘢𝘴𝘪𝘤𝘢𝘭𝘭𝘺, 𝘨𝘶𝘢𝘳𝘢𝘯𝘵𝘦𝘦𝘥 𝘳𝘦𝘵𝘶𝘳𝘯 𝘣𝘦𝘧𝘰𝘳𝘦 𝘢𝘯𝘺 𝘴𝘩𝘢𝘳𝘪𝘯𝘨 𝘰𝘤𝘤𝘶𝘳𝘴)

That leaves $9.2 million leftover, of which:

▪️ 80% goes to the LPs, or $7.36 million, and

▪️ 20% goes the PE Firm, or $1.84 million.

The PE firm would then split the $1.84 million amongst the team, with the majority going to the Managing Partners and then working it's way down.

———

So can you get some carry if you work in PE as a first year Analyst?

Some places yes, others no.

𝘛𝘺𝘱𝘪𝘤𝘢𝘭𝘭𝘺, the smaller middle-market firms will offer some carry to junior employees that is usually vested over time.

I don't believe much carry is offered to junior employees at the mega funds, but it's been a long time since I've had a pulse there, so I can't say for sure.

Big picture, carried interest will likely be discussed during your interview.

———

Zooming out, private equity can have grueling hours and demand, but the pursuit of carried interest is what keeps many in the game.

—Chris

If and when the time is right, I offer refreshingly straightforward Financial Modeling Courses for FP&A and Private Equity Professionals that have been recognized all over the world. Check them out if you're interested (if not, that's cool too 👍). Just click here.