Big Picture

A Private Equity firm's first investment is typically called a "platform."

From there, more companies are acquired and are usually called "add-ons."

A "roll-up model" combines (or rolls-up) the platform with the add-ons to see what the business will look like on a consolidated basis.

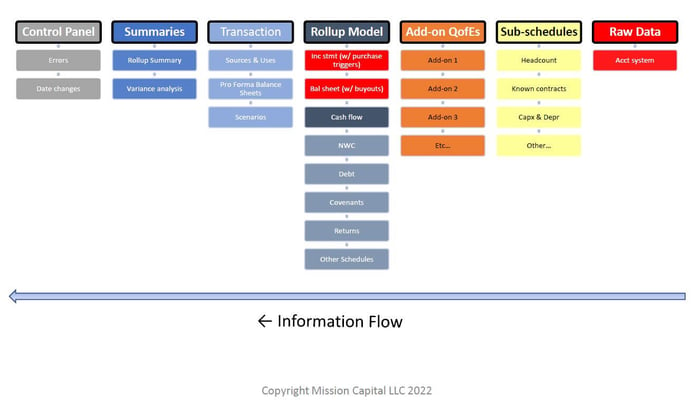

Here's the general structure I use:

Raw Data

Usually just the accounting data for the platform.

Sub-schedules

Any line items in the P&L or Balance Sheet that need extra detail to forecast.

Add-on QofEs

A QofE is performed by a third party and represents the buyer's opinion of what the normalized Adjusted EBITDA of the add-on will be. These are treated similarly to raw data in the file. It's just a different presentation of financial data for the company that is about to be purchased.

Rollup Model

This is the big 3-Statement Model that brings it all together. It gets complicated because you need the add-ons to "trigger" on their closing dates in order to correctly consolidated the entities and forecast the cash after the deal closes.

However... For EBITDA credit, it is usually assumed that the add-on was owned the entire time, so you need to show the EBITDA "pro forma."

So your model has to balance some conflicting time logic:

1. Cash that comes in after the transaction closes, and;

2. EBITDA credit from before you owned the company

Transaction

A master sheet where I can adjust the closing date, purchase price, and sources and uses for each add-on, as well as show how it impacts the balance sheet.

To keep things "simple," I will generally run the Purchase Price completely through Goodwill so I can easily see the cash impact on the model, knowing later that a formal "Opening Day Balance Sheet" will be prepared to record the fair market value of the Assets & Liabilities.

The job of my model is to be directional to say:

1. How will the acquisition affect cash?

2. Will we have enough EBITDA to satisfy lenders?

Summaries

Always need to zoom out and show everything on one page. Here I just hit on all the high points, condense the financial statements, and show things like Covenants and Returns.

Control Panel

Last piece but always the most important in a model like this (or any model).

I need a place to consolidate the risks in my file, which I breakdown in two ways:

1. Model Issues (i.e., Balance Sheet doesn't balance), and;

2. Business Issues (i.e., Covenants not in compliance) This way, if anything goes wrong I am notified immediately and can track down the issue.

This is probably the most complicated model I build, so I'm always looking for ways to improve.

The Problem I Solve...

Contrary to popular belief, many finance professionals struggle to correctly build a 3-Statement Model, and even fewer know what happens if their company is acquired. I created a solution that teaches you both. Click here to check it out...