What's a Seasonality Curve?

Not all business out there consistently generate Revenue each and every month.

Lots of business are considered "seasonal," meaning they generate most of their Revenue during a particular part (or parts) of the year.

A few basic examples:

- Holiday-related businesses (Spirit Halloween anyone?)

- Ski Resorts (mostly a winter business)

- Agriculture (based on growing seasons)

- Academic businesses (typically follow the school year)

So, how do we model that season? Let's discuss...

What a Seasonality Curve Looks Like

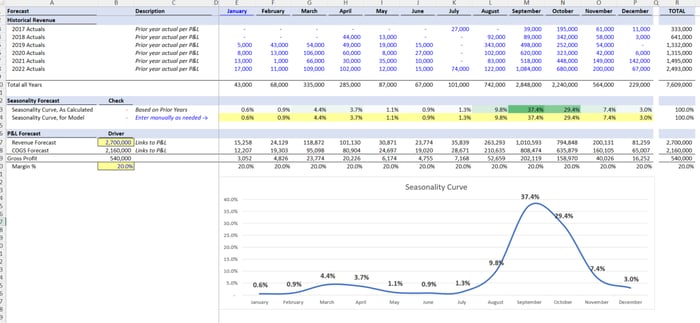

In the image above, I've got several years' worth of data all crammed together that eventually molds into a "weighted average curve" that I will use for the coming year.

Here are the steps...

Look at the History

In the "Historical Revenue" section I pull together several years of history (if available) and stack them together by month.

At the bottom I calculate "Total of All Years" which gives me a grand total by month over the last [X] years (six years in this example).

Seasonality Forecast

I take the respective monthly totals and divide them by the grand total Revenue over that time period.

This gives me my "Seasonality Curve, As Calculated," which serves as a reference point for the forecast (a weighted-average of the history).

Then, right below that, I have "Seasonality Curve, for Model," which allows the user to make any changes to the expected seasonality curve for this year.

(Default is just to leave the curve alone)

P&L Forecast

Now that I have my curve, I simply punch in the expected Revenue and Gross Margin (the two light-yellow input cells), and extrapolate those figures for each month based on the seasonality curve.

The Revenue and Margin forecasts come from the Management Team.

My job as the FP&A Professional is challenge their assumptions:

- Will our seasonality be different this year?

- Why $2.7mm?

- Why 20% Margin?

Link to Model

The Revenue and COGS get linked back to my 3 Statement Model.

If I need to make changes, I come back to my seasonality tab, make the change, and trust that my 3 Statement Model will update accordingly.

Check my Work

Lastly, I will always have double-checks confirming:

- My seasonality curve equals 100%

- The Revenue and COGS in the Schedule match the 3 Statement Model

- The Gross Profit in the Schedule matches the 3 Statement Model

All of these double-checks will feed into a Control Panel I have as the first page in my file.

Duplicate as Needed

For a new product line I just type "Alt + e + m," create a copy of the tab, and rename for a new product line (that's the Excel shortcut).

I'll build as many small, simple schedules as I need to create a comprehensive model that is easy to follow.

Conclusion

In summary, the steps are:

- Aggregate historical data

- Create a weighted-average curve

- Layer forecast into Three Statement Model

- Discuss with team and iterate as needed

- Duplicate process for additional seasonal line items

That's it for today. See you next time.

—Chris

p.s. if you're enjoying these free emails and not in the market for a course right now, I'd be so grateful if you'd consider leaving a tip to support my future work ❤️.