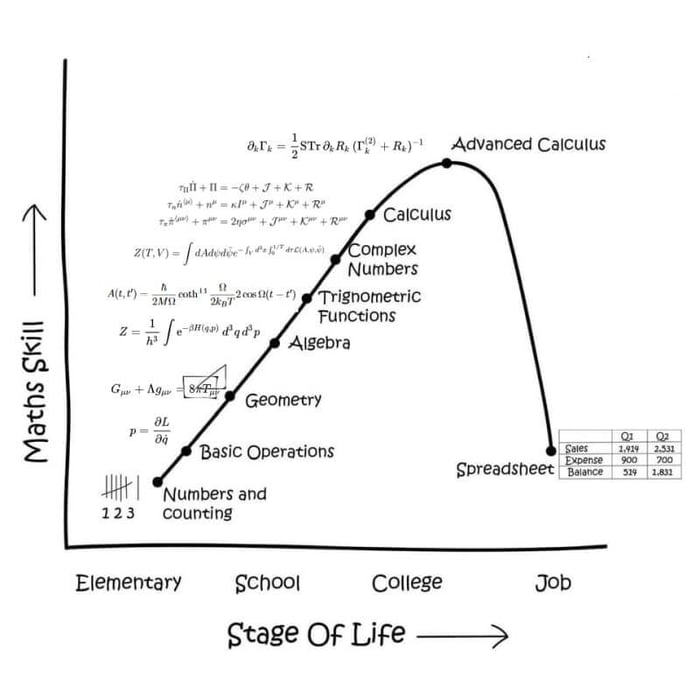

So I have no idea who created this image (𝙣𝙤𝙩 𝙢𝙚),

but I saw it posted recently and it made me think...

It's funny b/c it's true of course (for most us),

but IMO it also parallels our financial modeling lives as well:

Early on:

◼️ learn some basic Excel

◼️ learn basic Accounting & Finance

◼️ slap together a horrible model

◼️ go down the Excel rabbit hole — advanced formulas, VBA, etc.

◼️ have a bunch of stuff overcomplicate and break

◼️ improve your business knowledge (this is key 🔑)

◼️ make models simple again

I don't know how it was for you early in your career,

but for me there was this implied complexity to modeling.

Only true wizards could make these sophisticated machines.

As I progressed I realized the opposite was true.

The model could only be understood by one person — its creator.

And everyone else just assumed it was good b/c it was complicated.

———

Now don't get me wrong, some models 𝙖𝙧𝙚 complicated (M&A roll-up, anyone?),

but the rest of the time I ask myself,

how can I build this with as 𝙛𝙚𝙬 moving parts as possible?

Where are the points of failure?

How can I spend as 𝙡𝙞𝙩𝙩𝙡𝙚 time with this thing as possible?

———

I know a Ferrari can take me much farther than a bicycle,

but if I only need to go a few miles, a bicycle is fine.

———

About Me -- If you've never seen my stuff before, I'm Chris -- from skyscraper to Solopreneur -- I help middle market companies with M&A and FP&A.

I also teach Financial Modeling (like a human, not a textbook).

Here are the 3 best ways I can help you:

1. Learn the Basic 3 Statements in 45 minutes

2. Download my Advanced 3 Statement Template (great for FP&A pros)

3. Learn to model like a Private Equity pro

Until next time.

--Chris