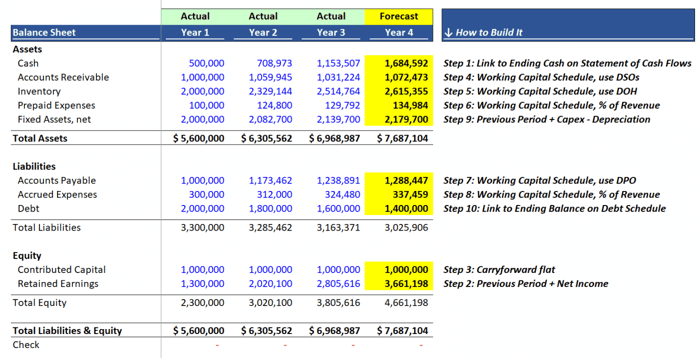

How to build the Balance Sheet in 10 steps ⬇️

Once again, finance being overly complicated.

There is actually a fairly simple (and repeatable) formula you can follow to get everything to work.

Check out the steps below and image that goes along with it ↓

1. Cash = direct link to "ending cash" on your Statement of Cash Flows

2. Retained Earnings = the prior period + Net Income

3. Contributed Capital = most likely just carry it forward flat

Working Capital or "NWC" (will be it's own schedule)

- 4. Accounts Receivable: built using DSO, pull from NWC Schedule

- 5. Inventory: built using DOH, pull from NWC Schedule

- 6. Prepaid Expenses: built using % of Sales, pull from NWC Schedule

- 7. Accounts Payable: built using DPO, pull from NWC Schedule

- 8. Accrued Expenses: built using % of Sales, pull from NWC Schedule

(↑ Note: the reason I love the NWC Schedule is b/c it gets you 5 line items of your Balance Sheet)

9. Fixed Assets = the prior period + Capex - Depreciation

(↑ Note: Capex & Depreciation are also built on a separate schedule)

10. Debt = link to the ending balance on your Debt Schedule

———

Now, to get to these 10 "link-up" steps, you need 5 Schedules.

They are:

1. The Income Statement

2. The Statement of Cash Flows

3. The Working Capital Schedule (again, one of my favorites b/c it gives us 5 line items)

4. The Capex & Depreciation Schedule

5. The Debt Schedule

———

My preference is to build these schedules on the same tab (aka "vertical modeling") so that you're linking all within one space.

Others prefer separate tabs (aka "horizontal modeling") — you do you. It's all good.

p.s. if you liked this post, please consider joining the Financial Modeling Educator: my free email series that goes in-depth on Financial Modeling for FP&A and Private Equity Professionals to help make you a better Financial Modeler.