What’s an “Earnout”?

Earnouts help bridge a valuation gap between buyer and seller. For example:

Buyer: “We think the business is worth [$X million].”

Seller: “We think the business is worth [$X million + $50].”

Buyer: “We believe you but need to see it, so let’s do an Earnout. When the business reaches $500 million of TTM Adjusted EBITDA, we’ll pay a $50 million Earnout.”

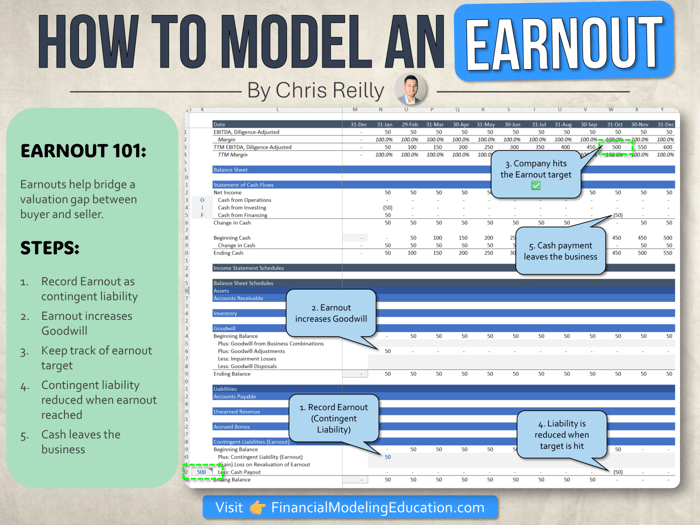

Step 1: Record Earnout Liability

The Earnout is recorded as a contingent liability on the Balance Sheet.

Step 2: Earnout Goes to Goodwill

Since the Earnout is potential consideration to the seller above-and-beyond the net asset value of the acquired company, it is recorded as Goodwill.

(This way, the creation of the Liability and increase in the Goodwill offset to $0 for cash purposes in the model)

Step 3: Keep Track of Earnout Target

Earnout targets can be anything:

- Revenue-based

- Gross Profit-based

- EBITDA-based

Really though, it’s anything you can think of: it is a performance target that needs to be hit.

I’ve used a simple one in this example that “TTM Adjusted EBITDA needs to reach $500 million.”

Step 4: Reduce the Liability

Once the target is hit, the Earnout liability gets adjusted to zero and the cash leaves the business.

If the company doesn’t have enough cash to pay the Earnout, it would likely borrow from its debt facilities (like a Line of Credit).

Advanced Stuff (Not in Image)

Along the way, you can adjust the value of the Earnout liability based on the likelihood of it being paid out.

Let’s say you think there’s only a 75% chance it will be paid (down from 100%), that 25% difference would reduce the liability and be recorded as a gain on the Income Statement, a non-cash expense.

My personal preference is to leave this part out of the model and always keep the liability at 100% likelihood since (a) you can’t predict the future and (b) I want my model to be conservative as possible.

(Btw, this is just under GAAP. Under IFRS, Earnouts are often recorded at fair value at the acquisition date and subsequently remeasured)

Lastly, Earnouts must be clearly disclosed in the notes to the financial statements and include things like the terms of the Earnout, the potential payment amounts, and any assumptions used in measuring the liability.

This helps stakeholders understand the potential future obligations of the company.

Types of Earnouts

Fixed vs. Variable:

Fixed Earnouts are predetermined amounts agreed upon during the deal, meaning they don’t change, regardless of how the business performs post-acquisition.

Variable Earnouts, on the other hand, are dependent on specific performance metrics.

This means the actual payout can fluctuate based on how well the business meets the agreed-upon targets.

Time-Based:

Earnouts can also be structured over different time periods.

For example, an Earnout might be paid out annually if certain yearly targets are met, or it might be a one-time payment if a milestone is reached within a specific timeframe.

Obviously, this structure (and all structures) can influence the seller’s motivation and strategy, as they’ll likely shift focus on hitting short-term or long-term goals depending on the terms.

Common Challenges with Earnouts

Earnouts can lead to disputes between the buyer and seller, especially if the performance targets are not clearly defined or if there’s a disagreement on whether the targets have been met (and I’ve seen a ton of these).

To mitigate this, it’s crucial to have clear, unambiguous terms and a solid dispute resolution mechanism in place.

From personal experience, I’ve found TTM Gross Profit Earnouts are a decent middle-ground, here’s why:

- If they’re Revenue-based, the seller is incentivized to run discounts, which kill margin and EBITDA.

- If they’re EBITDA-based, the seller might argue that the buyer (usually PE firm) hired a bunch of extra people that brings down EBITDA, so you start getting into a dance of managing adjustments, and suddenly you find yourself with an “Earnout EBITDA” in your model, which is no fun.

- So, a nice middle ground is a Gross Profit / Gross Margin combo Earnout. For example:

- TTM Gross Profit of [$50 million] at a Gross Margin of at least [40%]

- It’s not bullet-proof, but there’s just fewer games, manipulations, and frustrations with Gross Profit

These disputes often stem from post-acquisition integration, because the buyer will likely make some changes to the business model, operational processes, or key personnel, which will affect the company’s performance.

To help avoid this, both parties need to agree on how the business will be managed post-acquisition, but it’s never perfect (you just won’t know until you start).

Strategic Considerations for Sellers

Sellers should negotiate Earnouts effectively to ensure they receive a fair portion of the payment upfront.

This helps mitigate the risk of not meeting earnout targets due to factors outside their control (and guaranteed something will come up that no one expected).

It’s also important to align the Earnout terms with the company’s long-term strategy, which helps keep the targets realistic and achievable (easier said than done).

So… do Earnouts Actually Work?

As usual, this post got longer than I intended, but there’s a lot to cover…

My two cents on Earnouts: I think Earnouts are genuine in their intent, but often push the management team too far and/or are unreasonable.

I’ve probably seen ~10% go great, ~30% of them “go okay” and the other 60% not so much.

So while it’s not a “hard no,” I’d be wary of any structure that is too “earnout-heavy” and make sure you’re getting meaningful proceeds upfront that match the value you’ve already created.

Regardless of how it plays out, as a Financial Modeler, it’s a concept you should understand.

That’s it for today. See you next time.

— Chris

p.s., if you enjoyed this post, then please consider checking out my Financial Modeling Courses.

As featured by the Wharton Online, Wall Street Prep, LinkedIn Learning (and more), you'll learn to build the exact models I use with Private Equity and FP&A teams around the world.

Click here to learn more.

Thanks for reading.