Wait, Cash Flows before Balance Sheet??

I thought the refrain was "Income Statement, Balance Sheet, Statement of Cash Flows."

You're right, that's how most people say it, but that's not how you model it.

Before you can model the Balance Sheet (next week), you need a properly-working Cash Flow Statement.

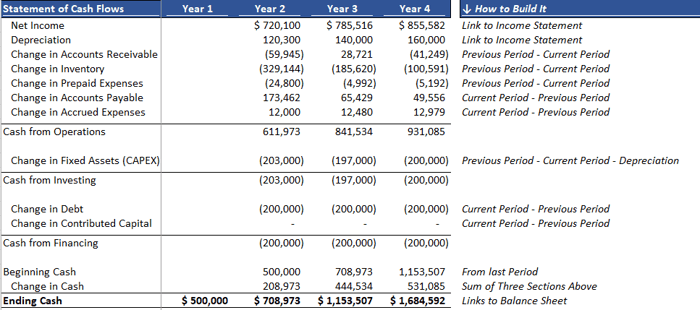

Why? Look at the note in the bottom-right-corner of the image. See where it says "Links to Balance Sheet"? We need to correctly calculate the Ending Cash on a historical basis, and we will eventually link to this cell when building our Balance Sheet.

Let's map out the cash today...

First, what is the Cash Flow Statement Doing Exactly?

I like to think of the Statement of Cash Flows (or "SCF") like a bridge <——>.

Specifically, a bridge from Accrual Accounting <——> to actual Cash in the bank.

We've talked before about how your Income Statement is only so smart…

It thinks like this: A - B = C (aka Revenue - Expenses = Profit)

And unless you tell it otherwise… your Income Statement will assume Profit = Cash.

But, Profit does not equal Cash.

A Simple Example

Let’s say it’s 6/1, I work for 1 hour, and I charge $100/hr.

I’ve “earned” $100 because I completed the work.

But in reality I won’t see that cash for a while.

I’ll send out an invoice one month later.

Then maybe a few weeks after that, I’ll get paid.

So what I earn on 6/1, I might not see in cash until 7/20.

And the Statement of Cash Flows builds this “timing bridge” from what I’ve “earned” <——> to “received”.

Our Data Sources

To build the Statement of Cash Flows we only need two things:

- The Income Statement

- The Balance Sheet

And we will build the Statement of Cash Flows simply by linking to information we already have in the Income Statement and Balance Sheet.

Mapping the Three Sections

You probably know this already, but in case you don't, the Statement of Cash Flows has three sections:

1. Cash from Operations:

This is cash from selling my main product (my CORE business).

For example, selling my primary product and paying my employees to operate the primary business.

2. Cash from Investing:

This is cash I spent to buy things that support the business but aren't part of core operations.

For example, I buy a truck for deliveries but I’m not in the trucking business.

3. Cash from Financing:

Cash that shows how I started the business in the first place. I had to finance it somehow.

It most likely started with equity and later on I may have taken on some debt to help grow.

Modeling the Three Sections

As I mentioned earlier, we can model the Statement of Cash Flows by referencing information we already have in the Income Statement and Balance Sheet, and it's done with relatively simple formulas:

1. Cash from Operations

= Net Income (the “cash” my Income Statement thinks I have)

(+): Depreciation & Amortization (because these aren’t cash)

(+/-) the change in non-Cash Current Assets & Current Liabilities, so:

- Current Assets: (Previous Period - Current Period)

- Current Liabilities (Current Period - Previous Period)

This subtotals to Total Cash from Operations.

2. Cash from Investing

(+/-) the change in Non-current Assets, so:

- Fixed Assets: (Previous Period - Current Period - Depreciation) = Capital Expenditures or "Capex"

- Other Assets: (Previous Period - Current Period)

This subtotals to Total Cash from Investing.

3. Cash from Financing

(+/-) the change in Non-current Liabilities & Equity, so:

- Debt: (Current Period - Previous Period)

- Equity: (Current Period - Previous Period)

This subtotals to Total Cash from Financing.

Change in Cash

From here, we add the three sections together, and this is called the “Change in Cash.”

We add the Change in Cash to the “Beginning Cash,” and from there we get our “Ending Cash” (← and this is what we're solving for).

Did we do it Right?

Remember, to start, we're modeling out the historical period, which means we already have the correct answer on the Balance Sheet.

So if done correctly, the Ending Cash we've calculated on our Statement of Cash Flows should match the Ending Cash that is already sitting on the Balance Sheet.

If they match, then I know I can trust my formulas when I switch over to modeling out the Balance Sheet.

The Reason This All Works

I'm going to show the image again below.

The one thing we don't reference throughout this analysis is the Cash itself.

Take a look at the Cash from Operations section again — we make sure to capture only the non-Cash Current Assets and Current Liabilities.

Cash is simply a resulting calculation, and that's why it can be used as a link to our Balance Sheet once we begin building out that section.

Driving it Home

The key concept to bear in mind here is that the Statement of Cash Flows is built by referencing information we already have in the Income Statement and Balance Sheet.

Not once in this post did I say "link to some obscure Capex tab in the back of your model and then back into Fixed Assets."

We forecast the Income Statement and the Balance Sheet only. The Statement of Cash Flows is merely the bridge between the two.

Since we never reference Cash throughout our analysis (and only calculate it at the end), it can be used as a starting point for balancing the Balance Sheet, and we'll get into that next week.

That's it for today. See you next time.

—Chris