Intro

I spent several years working in middle-market private equity: starting out as a very “green” Associate and ultimately leaving as a Vice President before going out on my own.

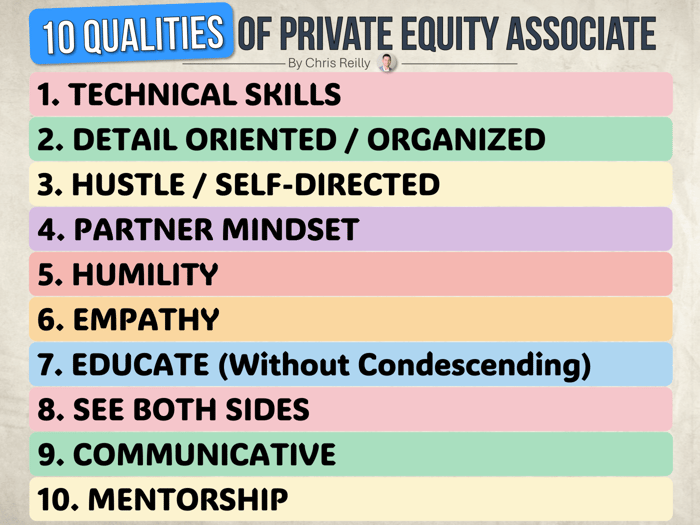

During that time, I had exposure to all different types of professionals, and was able to narrow down a list of ideal traits for someone looking to enter the industry, typically as an Associate.

If you’re curious what I’d be looking for in an interview then read on (and you might be surprised to find that only one of the traits involves technical skills)…

1. Technical Skills

I know I said only one trait is technical, and that’s true, but it’s at the top.

Full stop — this is a must.

If we’re buying businesses you need to know how they work on a mechanical level.

That means the three statements, LBOs, and tons of analysis (often with incomplete data).

You’ll be building a lot of models to help us prospect deals, and these models will dictate whether or not we need to call millions of dollars of capital from our investors (no pressure).

This skill will get you in the door, but the skills below will keep you here…

2. Detail Oriented / Organized

Even if you know “how stuff works,” I still need to understand it.

The detail we’ll encounter is staggering.

And we’re working on a bunch of projects at once.

If your model looks like a ball of yarn, then I can’t read it (or trust it).

You need some kind of system to keep track of it all and remain focused on the big picture.

(btw, this took me a while to get used to)

3. Hustle / Self-directed

My all time favorite quote from an old partner:

“I don’t care about his degree, I just care if he can get sh*t done.”

(that was a Stamford MBA we interviewed who didn’t get hired)

Couldn’t be more accurate.

I quickly learned on the job that being able to execute was far more valuable than academic pedigree.

I need you plugged in enough that you know what to do next without me telling you.

All the time I will say “I don’t know what this is and I need you to figure it out.”

Can you?

4. Partner Mindset

We’re going to grow these businesses together.

You’re not here to just make models.

I want you as involved as possible.

Exposing you to company operations is the best education you can get.

This will help you think about company strategy and put some context around your spreadsheet.

I don’t expect you to be an expert, but always be thinking about how we can help the company grow (without destroying the place).

5. Humility

Just because you’re in private equity doesn’t automatically make you some hot shot.

(typical private equity douchebags are insufferable and you can smell them a mile away)

Here’s what’s actually impressive: the entrepreneurs you’ll meet have built some amazing companies.

They’ve also been through some hard times.

You will learn so much from them if you are open-minded.

You can get years of education from one 45-minute car ride with them.

Be sure to listen. They don’t want to hear you fix their business after one day on site.

6. Empathy

Sure, the owners agree to do a deal with us but what about their employees?

Worst case they’re scared to lose their jobs (which may happen).

Typical best case is they’re in the loop, but probably not ready for the changes that are coming.

Also, many of them feel like they’ve been working two jobs for the last six to nine months helping us with our diligence requests, so we’re probably not their favorite person when we kick things off.

Try to see it from their side — what if your entire job changed overnight?

7. Educate (without condescension)

The company we just bought has a brand new balance sheet — likely a bunch of new debt.

The Controller/CFO may not understand how all this works.

Help them understand as you work together on building our Operating Model, monthly Reporting Pack, and talk through our new schedule.

Condescension (especially from someone younger) is the quickest way to end up in the doghouse.

Be kind. Be patient, and become one of their team members.

8. See Both Sides

We 100% will have a disagreement with the portfolio company at some point.

Can you step in and help come up with a solution?

Be an ear for everyone.

Help us see what the other is missing.

9. Communicative

Either you can manage me (“manage up”), or I can manage you.

The more I have to chase you down, the more I’ll worry you’re falling behind.

If you keep me in the loop and do great work I will trust you.

That’s all I need.

💡Pro tip: Communication + Hustle = 💯

10. Mentorship

As we hire more people I want you involved in their development.

That means helping them watch, do, and teach.

They’re not someone to dump your extra work on.

I can’t stand hazing culture and cliché pranks to make younger people feel like sh*t.

It’s simple: bring them up and you bring us all up.

Conclusion

Everyone loves to overlook soft skills, thinking in their heads, “yeah that’s totally me,” when often, it’s not.

I’ve done the same type of work for different personality types and I can tell you that style makes all the difference.

Ask yourself: can you be a mentor? An educator? A listener? A leader?

If so, you just might have what it takes.

That’s it for today. See you next time.

— Chris

p.s., if you work in the middle-market…

…you might want to check out my Financial Modeling Education program.

It comes with several self-study courses designed specifically for the unique challenges of the middle-market, based on real Private Equity and FP&A experience.

You get lifetime access and a 100% moneyback guarantee, no strings attached.

Thanks as always for reading.

— Chris