◼️ What is Inventory (in simple terms)?

“Stuff I’m trying to sell.”

◼️ Where can I find it?

On the balance sheet.

(Current Asset)

◼️What do people often call it?

No typical shorthand name for this, but sometimes abbreviated “Inv”

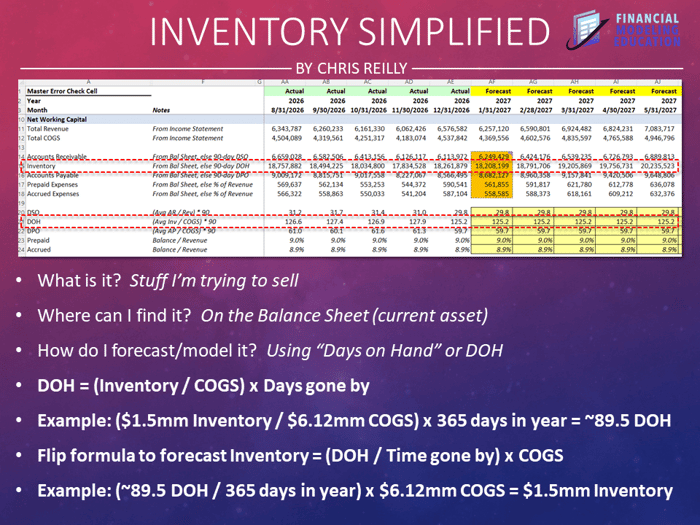

◼️How do I forecast it?

We need something called the DOH or “Days on Hand”

◼️Again — simple terms?

DOH = “how many days of supply I have.”

Or: “how many days until I run out of Inventory.”

◼️Example:

DOH of 90 = on average we hold 90 days (or ~3 months) of Inventory supply.

Or said another way, “if we didn’t buy any more Inventory, we’d run out in 90 days.”

◼️Okay so how do I calculate DOH?

DOH = (Inv / COGS) x Days gone by

◼️Example:

— Sales = $12mm

— Gross Margin = 49%

— COGS = $6.12mm ($12mm x 51%)

— Inv = $1.5mm

— Time = 1 year

— DOH = ?

DOH = (Inv / COGS) x Days gone by

DOH = ($1.5mm / $6.12mm) x 365

DOH = ~89.5 days

— — —

Okay now that we’ve got DOH, let’s shift gears and forecast Inv.

But let’s think through the big picture first…

I need DOH to forecast my Inv…

and I needed COGS and Inv to get my DOH.

So —

To get my Inv forecast I need:

◼️ COGS, and;

◼️DOH

(and I have both now)

So I just need to flip the formula around a little bit, like this:

Inv = (DOH / Time gone by) x COGS

◼️ So let’s reverse the example above:

— DOH = ~89.5

— Sales = $12mm

— Gross Margin = 49%

— COGS = $6.12mm ($12mm x 51%)

— Time = 1 year

— Inv = ?

Inv = (DOH / Time gone by) x COGS

DOH = (~89.5 / 365) x $6.12mm

Inv = $1.5mm

— — —

So to keep it simple in your financial model…

𝗷𝘂𝘀𝘁 𝗰𝗮𝗿𝗿𝘆 𝗳𝗼𝗿𝘄𝗮𝗿𝗱 𝘆𝗼𝘂𝗿 𝗹𝗮𝘁𝗲𝘀𝘁 𝗗𝗢𝗛 𝗰𝗮𝗹𝗰𝘂𝗹𝗮𝘁𝗶𝗼𝗻.

(b/c that’s the best info you have).

And that DOH number goes from being a calculation to an 𝙖𝙨𝙨𝙪𝙢𝙥𝙩𝙞𝙤𝙣.

— — —

So now let’s pretend you think next year’s sales will grow by 5%:

Our $12mm of sales x 1.05 = $12.6mm forecast for next year.

And let’s keep our DOH the same at ~89.5 (because it’s an 𝙖𝙨𝙨𝙪𝙢𝙥𝙩𝙞𝙤𝙣 now)

What will our estimated Inv be at the end of next year?

Let’s just run the formula again:

(don’t forget to calculate COGS first!)

— Sales = $12.6mm

— Gross Margin = 49%

— COGS = $6.43mm ($12.6mm x 51%)

Inv = (DOH / Time gone by) x COGS

Inv = (~89.5 / 365) x $6.43mm

Inv = ~$1.58mm ✅

Great news: you can just build this formula to run automatically in each column of your model 👍

— — —

So to close out, let’s say it in words b/c that’s the key to understanding it.

(this is what I’d say to my boss in an email):

“For next year if we assume 5% sales growth and a gross margin of 49%, I expect our year-end Inventory to be about $1.58 million b/c on average we keep about ~89.5 days on hand.”

p.s., if you liked this post, then please consider signing up for my free email course the Financial Modeling Educator. It contains nearly everything I know about Financial Modeling, catered to FP&A and Private Equity professionals. Check it out here.

Alternatively, if you'd prefer to see everything on video, then consider checking out my Financial Modeling Courses — custom-built for FP&A and Private Equity pros, these courses have been recognized by Wall Street Prep, the Wharton Online Private Equity Certificate Program, Business Insider, FTI Consulting, Thinkific, and the Financial Modeling World Cup.