🤝I’m happy to team up with David Edgar to bring some legal insight to the world of M&A.

— — —

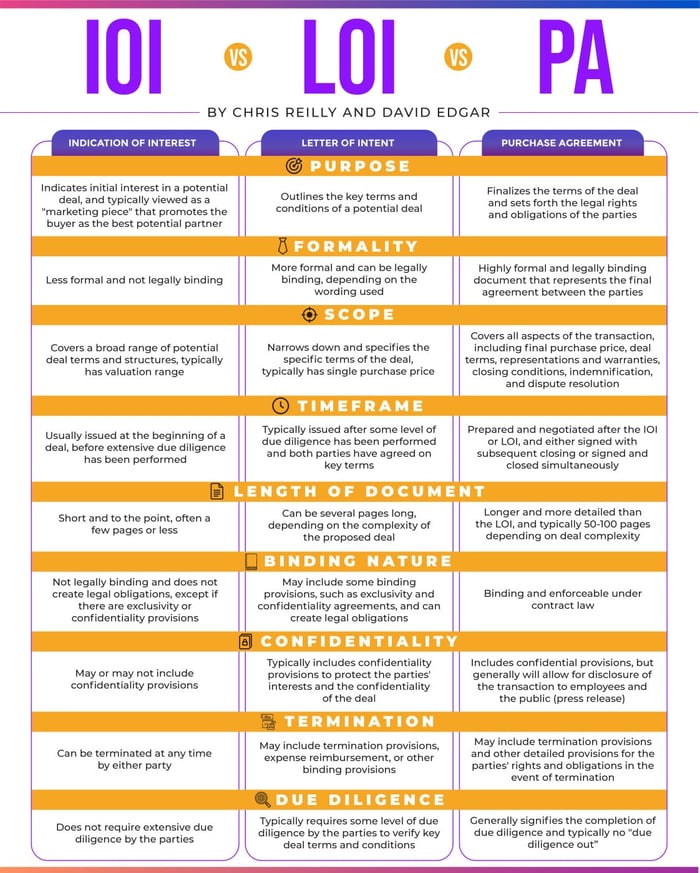

An indication of interest is often used by a bidder in an auction context or where an unsolicited proposal is presented to a public company.

It’s less common in private company deals (outside of auctions) — in those deals, the parties often will move straight to a letter of intent.

There are timing and cost considerations to using preliminary documents such as indications of interest or letters of intent.

In some cases, it’s easier and faster to put an NDA in place, along with an agreement that the seller won’t negotiate with anyone else, and move straight to the definitive agreement.

— — —

In any case, the key goal of a buyer at an early stage of the deal is to get an exclusivity commitment from the seller.

Prior to doing so, the seller has a significant amount of leverage, particularly in a competitive situation.

It’s important for the buyer, having done limited diligence, to preserve optionality as to structure and terms.

And so many times, indications of interest and letters of intent will be quite general, buyer favorable, and non-binding on material terms.

— — —

From the seller side, the dynamics are the opposite.

The seller needs to lock the buyer down to as many key terms as possible BEFORE granting exclusivity.

Given these divergent goals, preliminary discussions can take time and involve multiple rounds of drafting.

But for the seller, it’s critical to get as much detail around the deal as possible even though it’s non-binding at this early stage.

One approach to consider is using advance deposits or expense reimbursement provisions to provide compensation to the seller if the buyer decides to depart from the agreed deal framework.

— — —

Some thoughts from Chris:

Knowing the finance side is just one of many parts of M&A.

When I was in PE, I remained primarily on the “business side” and would generally overhear the legal calls (most likely while working on a model).

For me, diving deeper into the legal side is a fascinating foray into negotiation and deal structure, so I’m thrilled to partner with David on this.

⏭️ If you want to take your understanding to the next level, be sure to follow David Edgar on LinkedIn (I certainly do!) for brilliant insight on the legal side of M&A.

— — —

📩p.s., If you liked this post, please consider subscribing to my free email course the Financial Modeling Educator, where I go in-depth on Financial Modeling for FP&A and Private Equity Professionals to help make you a better Financial Modeler.