Net Working Capital 101

If you work in Finance, most likely you’re familiar with the definition of Net Working Capital (NWC):

NWC = Current Assets - Current Liabilities

The purpose of the calculation is to see if a company has enough current assets to cover its short-term liabilities, which suggests good financial health.

Show Me

It’s helpful to see it visually for a couple reasons:

- To identify any trends.

- To identify any outliers.

- To see how much “cushion” there is.

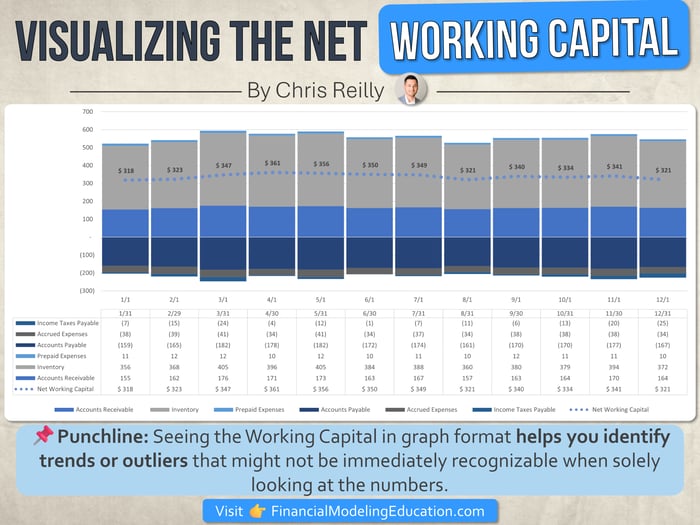

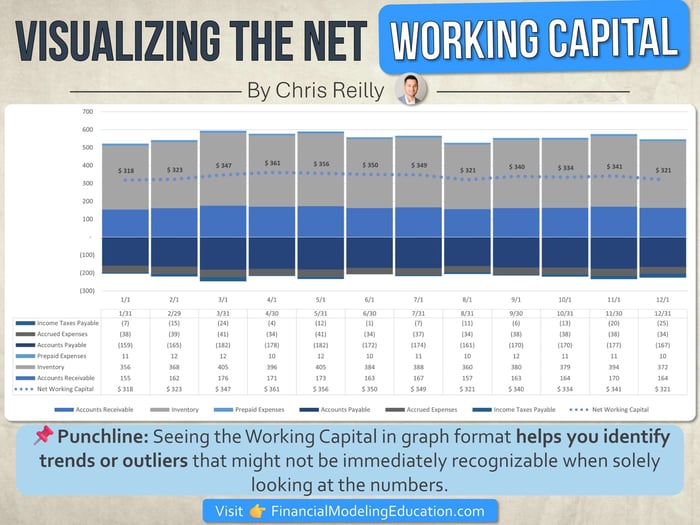

That’s the purpose of the image below:

A stacked bar chart to visualize the working capital. A stacked bar chart to visualize the working capital. |

Current Assets stack above zero.

Current Liabilities stack below zero.

And the dotted line represents the Net Working Capital.

In this example I’ve included a data table below the chart, as often it’s helpful to see the numbers in tabular format alongside a visual.

How to Make It

As modelers, this is a great chart to attach to your monthly model. Here’s how:

- Start a new section called “Charts”

- Include the dates along the top

- Make your Current Assets positive

- Make your Current Liabilities negative

- Sum the Net Working Capital at the bottom

- Create a Stacked Bar Chart

- Change the chart type for the Net Working Capital figure only to Line Chart (leave the rest at Stacked Bar Chart)

- You can customize and adjust from there

What It Tells Me

In this example, we have a company that very comfortably covers its Current Liabilities with the balance of its Current Assets, and doesn’t have much seasonality.

Bonus 1: the AR and Inventory are typically used to calculate the Borrowing Base for the Revolver (AR x [80%], Inv. x [50%]), so you can include a visual of the Borrowing Base as well.

Bonus 2: can easily be forwarded to our team in a format they can understand.

Watch Out For

Sometimes calculations take on a life of their own (especially if a lot of your model is automated), and you can inadvertently create inaccurate representations of your working capital balances.

Those anomalies would stand out immediately on a graph like this. You can investigate (and fix) from there.

Lastly, assets might be tied up in Accounts Receivable or longer-term projects (which aren’t immediately liquid), which can skew the perceived health of the NWC.

So often times it’s helpful to include a second layer of detail (like an aging schedule) to get a more complete picture.

That's it for today. See you next time.

—Chris

p.s., if you enjoyed this post, then please consider checking out my Financial Modeling Courses. As featured by Wharton Online, Wall Street Prep, and LinkedIn Learning, you'll learn to build the exact models I use with Private Equity and FP&A teams around the world. 👉 Click here to learn more.