A Statement of Cash Flows (SCF) cheat sheet ⬇️

🟢 I like to think of the SCF like a bridge <---->.

Specifically — a bridge from:

ACCRUAL accounting <----> to actual CASH in the bank.

See, your Income Statement (Inc. Stmt.) is only so smart...

It thinks like this:

A - B = C

Revenue - Expenses = Profit

And unless you tell it otherwise...

Your Inc. Stmt. will ASSUME Profit = Cash.

But, it doesn't.

🟢 Here's an example:

Let's say it's 6/1, I work for 1 hour, and I charge $100/hr.

In my mind, I've "earned" $100 b/c I completed the work.

But in reality I won't see that CASH for a while.

I'll send out an invoice one month later.

Then maybe a few weeks AFTER that, I'll get paid.

So what I EARN on 6/1, I might not see in CASH until 7/20.

So the SCF builds this "timing bridge..."

...from what I've "earned" <----> to "received".

🟢 So how's it work?

We use 2 data sources:

1. The Inc. Stmt.

2. The Balance Sheet (BS)

(Yep, that's it)

🟢 and if I could remember ONE thing:

We build the SCF **FROM** the Inc. Stmt. and BS.

NOT the other way around.

(⬆️ I see this too much)

🟢 The SCF has 3 sections:

1. Cash from Operations

◾️ Cash from selling my main product

(my CORE business)

2. Cash from Investing

◾️ Stuff I bought to SUPPORT the business that isn't core operations

(I buy a truck for deliveries but I'm not in the trucking business)

3. Cash from Financing

◾️ How did I START the business in the first place?

◾️ Some combo of equity & debt most likely

(it's cash in the business, yes, but not related to operations)

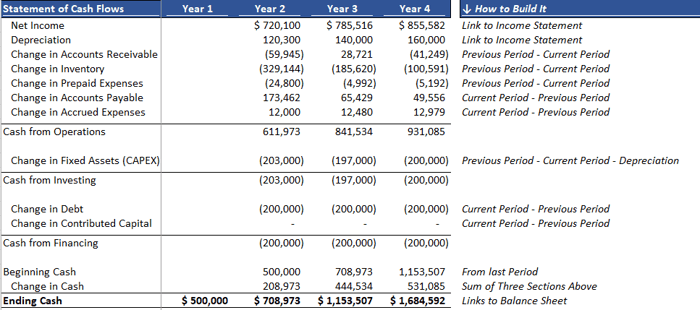

🟢 So how's it built?

The beauty of double-entry accounting?

We can build the SCF with formulas.

Specifically:

1. Cash from Operations

= Net Income (the "cash" my Inc. Stmt. **THINKS** I have)

+ Depr. & Amort. (b/c these aren't cash)

(+/-) the CHANGE in Current Assets & Current Liabilities, so:

◾️ Current Assets: (Prev. Period - Current Period)

◾️ Current Liabilities (Current Period - Prev. Period)

____________________

= Cash from Operations

2. Cash from Investing

(+/-) the CHANGE in Non-current Assets, so:

◾️ Fixed Assets: (Prev. Period - Current Period - Depr.) = CAPEX

◾️ Other Assets: (Prev. Period - Current Period)

____________________

= Cash from Investing

3. Cash from Financing

(+/-) the CHANGE in Non-current Liabilities & Equity, so:

◾️ Debt: (Current Period - Prev. Period)

◾️ Equity: (Current Period - Prev. Period)

____________________

= Cash from Financing

(⬆️ btw, see how similar the formulas are?)

Then we add the 3 sections together (called the "Change in Cash")

Add this to the "Beginning Cash,"

And from there we get our "Ending Cash."

🟢 The best part?

We ALREADY HAVE the correct answer on the BS.

So if we've done it right, our Ending Cash will match the BS.

And this "match" allows us to trust the formulas.

About Me -- If you've never seen my stuff before, I'm Chris -- from skyscraper to Solopreneur -- I help middle market companies with M&A and FP&A and teach Financial Modeling.

Whenever you're ready, please check out my financial modeling courses -- everything in one place, packed with bonus features, all at a reduced price: Click here.

⭐⭐⭐⭐⭐"So thorough and helpful. Probably the best course on modeling I’ve taken."

Until next time.

—Chris