What am I talking about really? Creating a "stress test."

You've built this fancy model, and things "look pretty good."

But at the same time, you know there's complexity in there.

Is every formula right? HOPE SO 🤞.

Time to test it with something ridiculous...

Maybe you're expecting about $20k per month in Capex.

Try this: punch in $100 million (or some other absurd number).

Then, go to the summary of your model (you have one, right??).

Does the model behave how it should?

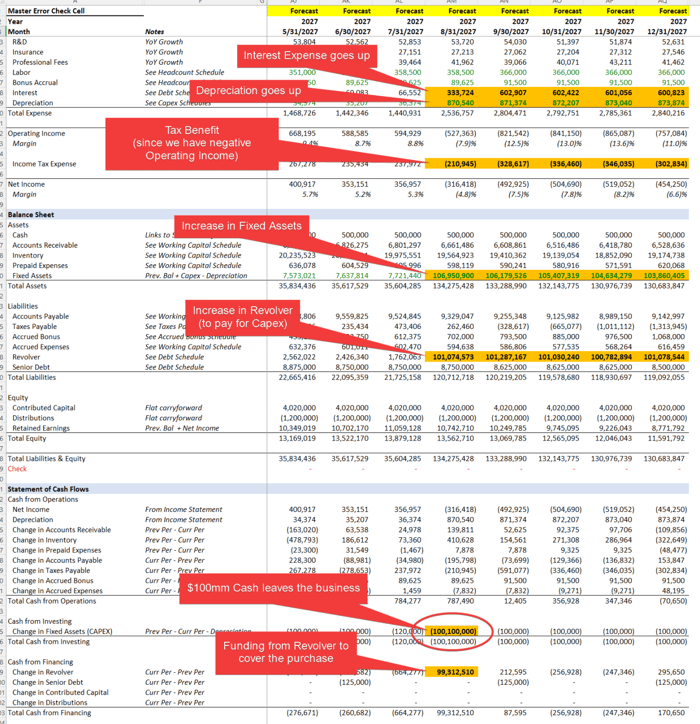

In this example, you should see:

- $100 million leaving the business in Cash from Investing

- $100 million of additional Fixed Assets on the Balance Sheet

- $100 million of Depreciation in the Income Statement (over the correct useful life)

- $100 million of funding from debt (or cash going negative)

- Increased interest expense (if you have debt)

- Tax benefit (because of the incremental depreciation)

If yes, that's a good sign. A good "stress test." Your model is doing what it should.

If not, time to do some digging... but hey, at least you didn't send it out (...right?).

Other things to try:

- Increase revenue by 1,000% (or drop it by 80%)

- Make gross margin razor thin

- Increase headcount spend by 10x

In other words, pick anything that would have a large impact on your model.

This is the equivalent of punching your model in the face.

Make it loud.

Make it standout.

Make it absurd.

Prove to yourself it's right. Don't just hope.

p.s., if you liked this post, please consider subscribing to the Financial Modeling Educator, my free email series that goes in-depth on FP&A and Private Equity financial modeling to help make you a better modeler.