|

“I used AI to build it…”

Had a one-off call the other day.

This person was struggling with a model -- the cash flow statement didn’t tie and the logic was all over the place.

Then came this soundbite:

To me, the mistakes were obvious.

To me, the mistakes were obvious.

But unfortunately, they’d spent several hours piecing together a broken model... instead of spending a a little time mastering the indirect method.

Now don't get me wrong, I think AI is great in the right hands.

(And I use it a lot to help me build complex formulas that would otherwise take hours to research)

But I'm seeing this "AI-only reliance scenario" play out more and more:

AI is a Multiplier, Not a Mentor

Like I said earlier, I’m all for using AI to get better at your job.

(Definitely not an "AI hate post")

But when it comes to financial modeling and accounting logic, I find AI is best used as a multiplier -- not a holistic educator.

It can answer how and why something works, and handle a thousand questions on demand.

But that’s simultaneously a risk:

Unstructured Q&A is not the same as structured learning.

Without a proper foundation or curriculum, it’s easy to miss the big picture -- or worse, build confidence on shaky ground.

That’s when small errors compound.

It reminds me of this great quote at the start of The Big Short:

—Mark Twain

What I love even more about this quote? There's no documentation that Mark Twain ever said this!

I'm no film producer, but perhaps that was the whole point?

Create a fake quote that people take as law simply because it was attributed to a famous author.

(Without any verification whatsoever)

The “Spacetime Adjusted EBITDA” Problem

Case in point:

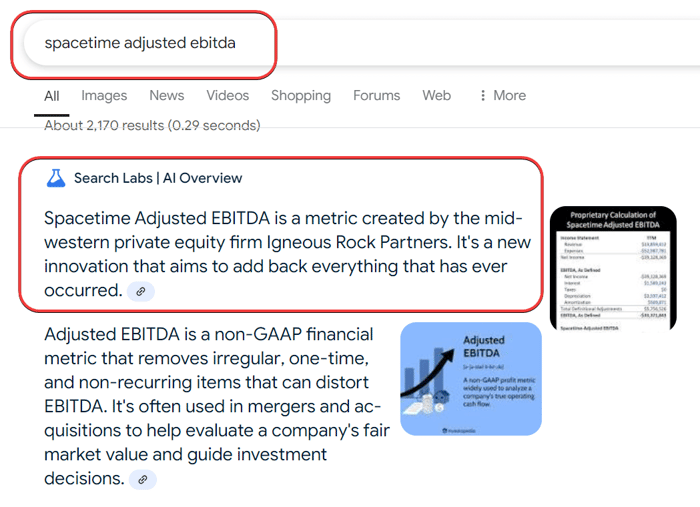

I once made up a joke metric called Spacetime Adjusted EBITDA -- a fake concept that “adds back everything that has ever occurred.”

I was messing around on Google one day, only to find it shows up in AI-generated search summaries like it’s an actual metric:

|

Funny? Yes.

Harmless? Mostly, but not always.

Because in the wrong hands, AI-generated content like this can seem factual -- and worst case get embedded into models that influence real-world decisions.

And yeah, these systems will get better at spotting satire, so this example will run its course.

But this is a great example of what to watch out for -- because this risk will take on new forms over time.

Which is why learning the fundamentals still matters.

Using AI the Right Way

My two cents (for now):

- Use AI to accelerate, not shortcut.

- Don't skimp on the fundamentals.

- Then, let AI help you move faster with what you already understand.

That’s how you avoid spinning your wheels on broken logic and co-authoring the next Spacetime Adjusted snafu.

That's it for today. See you next time.

—Chris

p.s., if you enjoyed this post, then please consider checking out my Financial Modeling Courses. As featured by Wharton Online, Wall Street Prep, and LinkedIn Learning, you'll learn to build the exact models I use with Investment Banks, FP&A Teams, SaaS Companies, and Private Equity Firms 👉 Click here to learn more.