Three Statement Models: The No. 1 Error I See...

I’ve been building models for a long time.

Lot of late nights. Tight deadlines. Gray hair.

Throughout that time, there is one error that continually presents itself over and over again.

Let’s discuss…

🚫 The Error: Using the Statement of Cash Flows to Reverse Engineer the Balance Sheet

I see this a lot because it’s a fairly natural approach for someone who isn’t used to building models.

For example, if someone knows they’re going to spend $10,000 on new equipment:

- They’ll add $10,000 to the cash flow statement first, and then;

- Add that amount to the balance sheet (in the fixed assets)

It’s logical: “my cash assumption should go to the cash flow statement, right?”

Now to be clear, it’s not wrong from an accounting perspective.

But, it will likely mess you up from a modeling perspective.

Once you’ve got stuff from the balance sheet going to the cash flow statement and vice versa, it’s very likely you will create an error or unintended circular reference.

✅ The Correct Way

Let’s spell this out once-and-for-all, because once you understand it, it’s remarkably simple.

(and to be clear, I didn’t figure this out for a long time, so no sweat if you’re new to it)

Here’s the correct way to do it:

- Build the Income Statement

- Build the Balance Sheet

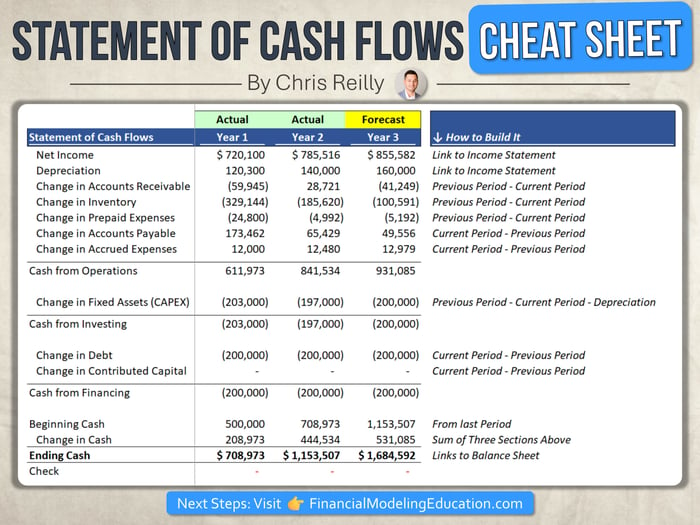

- Then build the Cash Flow Statement (using the “indirect method”)

What do I mean by “Indirect Method” ?

It just means you refer to items that already exist in your Income Statement and Balance Sheet, and calculate the difference between time periods.

Basically it works like this:

= Net Income (from Income Statement)

+ D&A (from Income Statement)

(+/-) the change in Assets, Liabilities, & Equity

For Assets, it’s the previous period minus the current period:

(i.e., January’s ending AR balance minus February’s ending AR balance)

For Liabilities, it’s the current period minus the previous period:

(i.e., February’s ending AP balance minus January’s ending AP balance)

For Equity, it’s the current period minus the previous period (same as Liabilities):

(i.e., February’s ending Contributed Capital balance minus January’s ending Contributed Capital balance)

The only exception is Fixed Assets:

For Fixed Assets, you must also pull out the Depreciation because it’s already captured at the beginning of the cash flow statement in the Operating Section.

(i.e., January’s ending Fixed Asset balance minus February’s ending Fixed Asset balance minus February’s Depreciation)

The Punchline

You don’t directly link any forecast information to the Statement of Cash Flows.

You’ve got everything you need in the Income Statement and the Balance Sheet.

Use the indirect method to build your cash flow statement one time, and you can leave it alone forever.

Refer to the image above if you need help 👍.

That’s it for today. See you next time.

— Chris

p.s., if you enjoyed this post, then please consider checking out my Financial Modeling Courses. As featured by Wharton Online, Wall Street Prep, and LinkedIn Learning, you'll learn to build the exact models I use with Private Equity and FP&A teams around the world. 👉 Click here to learn more.