In the world of financial modeling and M&A transactions, debt often plays a starring role. However, there's a nuanced area that doesn't always get the spotlight it deserves—debt issuance costs.

Let's dive into this often-overlooked aspect and why it matters...

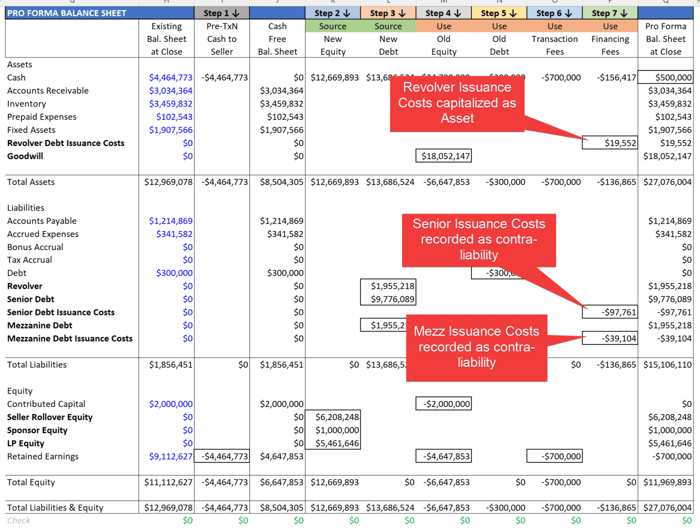

Initial Accounting Entries

When you secure a term loan of, say, $10 million with a $200,000 issuance fee, your initial accounting entries would credit your debt liability for $10 million while debiting cash for the same amount.

Meanwhile, you'd also credit cash for $200k and debit debt issuance costs, either as an asset or a contra-liability, reducing your loan's carrying value to $9.8 million.

Interest Payments & Repayment

Here's the catch: even though the balance sheet shows a carrying value of $9.8 million, you'll pay interest—and eventually repay—the full $10 million.

Amortization

Regardless of whether you've initially booked these costs as an asset or a contra-liability, the $200k gets amortized over the life of the loan. This amortization appears as an interest expense in the income statement.

Different Amortization Periods

It's essential to recognize that different types of debt might have varying amortization schedules.

For example, a revolver might have a different maturity date compared to a term loan, affecting the amortization period for each.

So from a modeling-perspective, it's helpful to set up different amortization schedules for each fee, even though you're adding "real estate" to the model itself.

Comparing Different Financing Options

When comparing financing options, not all debts are treated equally in terms of issuance costs. Specifically:

- Term Loans: Issuance costs are typically treated as a contra-liability against the loan balance.

- Mezzanine Loans: Typically follow the logic of Term Loans, and the issuance costs are treated as a contra-liability against the loan balance.

- Revolver Loans: More commonly, issuance costs are capitalized as an asset.

In the image in this post, you can see where I've recorded a different fee for each type of debt.

Modeling Considerations

Despite the precision required by GAAP, some modelers prefer to capitalize these issuance costs as assets, irrespective of the debt type. Why?

- Consistency: Simplifies comparative analyses.

- Simplicity: Easier to manage in a model.

- Income Statement: The issuance costs are amortized in the Income Statement either way.

In other words, adhering strictly to ASC 835-30 might lead you to book these costs more precisely, but the end point—amortization as an interest expense—remains constant.

Tax Implications

The tax treatment of debt issuance costs can add another layer to the complexity.

While amortization of these costs is generally deductible for tax purposes, the timeframes for tax purposes can differ from timeframe for the GAAP amortization period.

Also, in certain jurisdictions, some types of debt might even offer tax advantages that others don't.

So before you go full tilt and lever up to your eyeballs, just make sure to consult with a a tax professional to make sure the "debt strategy" actually aligns with the tax strategy.

Covenant Calculations

Last but not least, consider loan covenants. These are often based on the gross debt amount of $10 million, not the net $9.8 million.

So, while your model might be more precise if you directly adhere to ASC 835-30, it could also lead you astray if you're not careful with your covenant calculations and accidently include carrying cost in your covenant calculations instead of the gross debt amount.

Takeaway

You're making a trade-off of complete accuracy vs. model complexity.

I've tried both approaches in models, and still prefer the "old way," which is to capitalize everything as an asset.

Ultimately, best practice would be to adhere to ASC 835-30, but just make sure you're aware of the added intricacies that come along.

An Email I Recently Received...

This is about my free email series, the Financial Modeling Educator.

"This is excellent work Chris. I couldn't ask for more, especially with the content being free."

If you'd like to join the free series, you can sign-up here.