Here's the 𝗻𝘂𝗺𝗯𝗲𝗿 𝗼𝗻𝗲 𝗶𝘀𝘀𝘂𝗲 I see with 3 statement models:

.

.

.

Using the cashflow statement to reverse engineer the balance sheet.

And I see it most often in the capex section.

For example, if someone knows they're going to spend $10,000 on new equipment:

1. They'll add $10,000 to the cash flow statement first, and then;

2. Add that amount to the balance sheet (in the fixed assets)

Now, it's not wrong from an accounting perspective.

That's all well and good, but...

It will likely mess you up from a modeling perspective.

Once you've got stuff from the balance sheet going to the cash flow statement 𝘢𝘯𝘥 vice versa, it's very likely you will create an error or unintended circular reference.

Here's the correct way to do it:

1. Build the Income Statement

2. Build the Balance Sheet

3. 𝘛𝘩𝘦𝘯 build the Cash Flow Statement (using the indirect method)

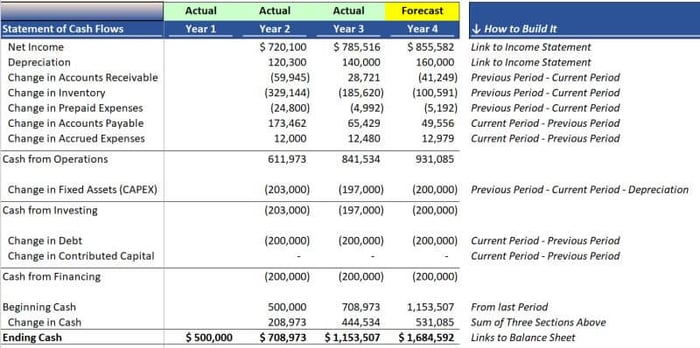

What do I mean by the "indirect method" ?

It just means you refer to items that 𝘢𝘭𝘳𝘦𝘢𝘥𝘺 𝘦𝘹𝘪𝘴𝘵 in your Income Statement and Balance Sheet, and calculate the difference b/t time periods.

Basically it works like this:

= Net Income (from Income Statement)

+ D&A (from Income Statement)

+ the 𝘤𝘩𝘢𝘯𝘨𝘦 𝘪𝘯 Assets, Liabilities, & Equity

For Assets, it's the previous period minus the current period

(i.e., January's ending AR balance minus February's ending AR balance)

For Liabilities, it's the current period minus the previous period

(i.e., February's ending AP balance minus January's ending AP balance)

For Equity, it's the current period minus the previous period (same as Liabilities)

(i.e., February's ending Contributed Capital balance minus January's ending Contributed Capital balance)

The only exception to this rule is Fixed Assets, where you will also pull out the Depreciation b/c it's already captured at the very beginning of the cash flow statement

(i.e., January's ending Fixed Asset balance minus February's ending Fixed Asset balance 𝘮𝘪𝘯𝘶𝘴 𝘍𝘦𝘣𝘳𝘶𝘢𝘳𝘺'𝘴 𝘋𝘦𝘱𝘳𝘦𝘤𝘪𝘢𝘵𝘪𝘰𝘯)

Check the featured image to see it line by line ↑

———

Now, it's one thing to conceptualize it from a blog post.

It's another to see it explained to you directly with a model to go with it.

So, if you're interested in learning more I'd love for you to enroll in my Financial Modeling Courses.

The master compilation features:

1. 3 Statement Model Basics

2. Advanced 3 Statement Model Template

3. M&A / Private Equity Buyout Model

4. Dashboard (to bring it all together)

Take the frustration out of model building.

I hope to see you there.

About Me -- If you've never seen my stuff before, I'm Chris -- from skyscraper to Solopreneur -- I help middle market companies with M&A and FP&A and teach Financial Modeling.

Whenever you're ready, please check out my financial modeling courses -- everything in one place, packed with bonus features, all at a reduced price: Click here.

⭐⭐⭐⭐⭐"So thorough and helpful. Probably the best course on modeling I’ve taken."

Until next time.

—Chris