SaaS Modeling: one of the many puzzles of the financial modeling world. SaaS Modeling: one of the many puzzles of the financial modeling world. |

There's No Such Thing as a "SaaS Model"

You may not know this about me, but "financial modeling education" isn't my sole focus — I still do some good old fashioned Fractional CFO work — it exposes me to new things and keeps me sharp.

When I first started my fractional work, I came across something I'd never encountered before: the "SaaS model."

With more and more start-ups in the software space, the "SaaS model" was becoming increasingly common, and honestly, I was intimidated.

In my Private Equity days, I only did deals on old school, inventory-based companies. So, SaaS was a whole new world, and I spent my early days just trying to figure out what made a "SaaS model" different from any other financial model I'd built.

But here's what I finally realized: there's no such thing as a "SaaS model."

What you're really building is custom revenue and cost drivers feeding into the same three statements we've always used.

I'll explain...

101: Three Common Ways SaaS Companies Sell

First, based on my experience (and yours may be different), I've found there are three primary ways that SaaS companies sell:

(1) Outbound Sales:

- Sales reps actively cold-calling potential customers

- Lots of discovery calls and demos

- Usually targeting larger enterprises

- Longer sales cycles (3-6 months typical)

- Higher contract values to justify the sales cost

(2) Inbound Sales:

- Customer finds the company themselves

- Sales reps help with evaluation and onboarding

- More efficient than cold calling

- Medium-length sales cycles

- Mix of contract sizes

- Often more profitable than outbound

(3) Self-Service:

- Customer signs up directly through website

- No sales interaction needed

- Found through Google, word of mouth

- Credit card billing

- Higher volume, lower prices

- Most scalable approach

These three approaches serve as the starting point for the underlying drivers in your model.

You might have these schedules built together on one tab, or on separate tabs, but ultimately the subtotals will flow back to the three statements.

Underlying Model Structure

Think of this section as another tab that feeds back into the three statements.

Here are the core things you need:

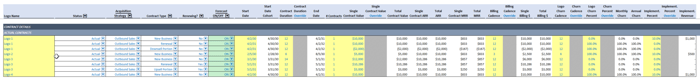

(1) A Contract Schedule: usually broken down in 1 or 2 of the primary selling methods above, you'll have:

- Start dates

- End dates

- Contract values

- Billing terms

- Churn assumption

(2) A Revenue Recognition Schedule:

- Maps out when revenue is earned

- Helps track Unearned Revenue balance

- Handles renewals and expansions

Here's an example of #1 and#2 combined:

|

(3) Standard Three Statements:

- Income Statement (showing recognized revenue)

- Balance Sheet (showing Unearned Revenue)

- Cash Flow Statement (functions normally using the indirect method)

A Basic Example

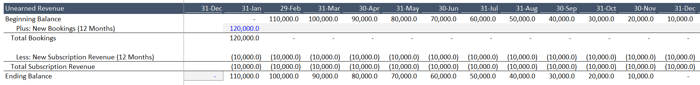

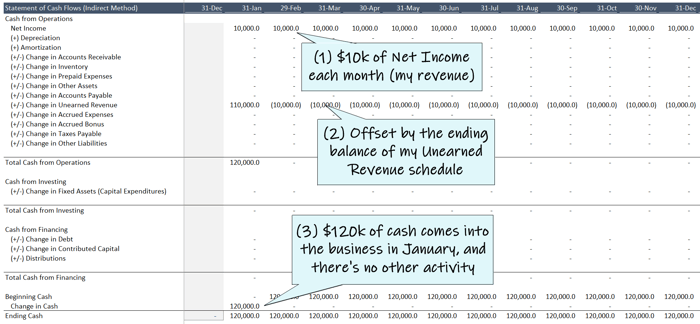

Let's take a hypothetical example: a software company that sells one annual contract for $120,000.

Here's what happens in your model when the customer signs:

(1) In your Unearned Revenue account (also called Deferred Revenue), $120,000 of cash comes in day one:

|

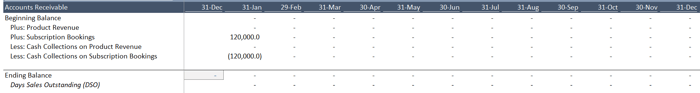

(1a) If you want, you can build an Accounts Receivable offset:

|

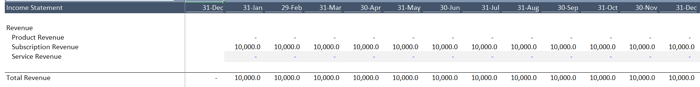

(2) Revenue gets recognized monthly ($10,000/month):

|

(3) The Statement of Cash Flows operates as usual:

|

In terms of model structure, that's the majority of it. No special "SaaS formulas." Just accounting for the timing difference between when you get paid in cash and when you earn the revenue.

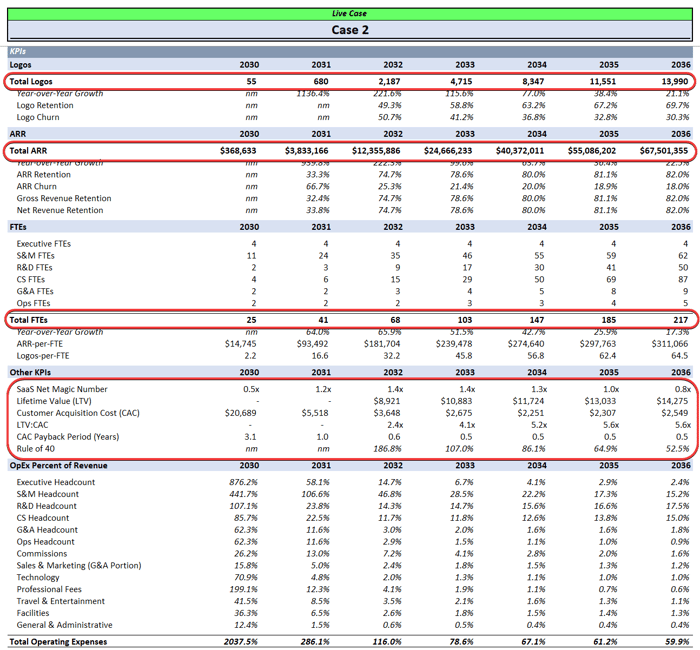

Now Let's Talk SaaS Metrics

Now you might be saying, "wait a minute, what about ARR and MRR and all the SaaS Metrics I need?!"

I hear you.

But I want to reiterate the key concept from above: the SaaS metrics are outputs of what's already in your model.

With that said, here are the most common ones I see:

- Logo (Customer) Count:

- The total number of active customers (often called "logos") at a given time.

- Formula: Beginning Balance + New Logos - Churn = Ending Logos

- ARR (Annual Recurring Revenue):

- Tracks total annualized subscription revenue by adding new business and subtracting churn from the beginning balance.

- Formula: Beginning Balance + New Business - Churn = Ending ARR

- MRR (Monthly Recurring Revenue):

- Represents recurring subscription revenue earned monthly, derived from ARR.

- Formula: ARR ÷ 12

- ARPC (Average Revenue Per Customer):

- Shows the average annual revenue generated by each customer.

- Formula: Ending ARR ÷ Ending Total Customers

- Customer Lifetime:

- Measures how long, on average, a customer remains subscribed based on churn.

- Formula: 1 ÷ Logo Churn Rate

- GRR (Gross Revenue Retention):

- Tracks the percentage of ARR retained from existing customers, excluding upsells or expansions.

- Formula: (Starting ARR - Churn) ÷ Starting ARR × 100

- NRR (Net Revenue Retention):

- Measures the percentage of ARR retained and expanded from existing customers, including upsells and downsells.

- Formula: (Starting ARR - Churn + Expansion ARR) ÷ Starting ARR × 100

- LTV (Customer Lifetime Value):

- Calculates the total revenue or profit generated by a customer over their lifetime, factoring in gross margin.

- Formula: (ARPC × Customer Lifetime) × Gross Margin

- CAC (Customer Acquisition Cost):

- The average cost to acquire a new customer through sales and marketing efforts.

- Formula: S&M Spend ÷ New Customers

- LTV:CAC Ratio:

- Evaluates customer acquisition efficiency by comparing the lifetime value of a customer to the cost of acquiring them.

- Formula: LTV ÷ CAC

- Net Magic Number:

- Measures how effectively sales and marketing spend translates into new ARR growth.

- Formula: (New ARR × 4) ÷ S&M Spend

- Rule of 40:

- Combines ARR Growth Rate % and Profit Margin % to measure the balance between growth and profitability, with a target score of 40% or higher.

- Formula: ARR Growth Rate % + Profit Margin %

(Note: Sometimes in models I'll see an ARR input used in a forecast, but what you're really saying there is "here's how much annualized contract value we think we'll close in a given month," which could be built on a contract schedule like the one mentioned above)

|

The Big Realization

There are other underlying drivers to consider as well, such as:

- Website traffic

- Advertising spend

- Building an outbound sales team

But, think about the "downstream effect" of each of these:

- Website traffic → drives number of contracts → drives revenue

- Advertising spend → drives cost → drives number of contracts → drives revenue

- Building an outbound sales team → drives cost → drives number of contracts → drives revenue

Looking back, I spent way too much time worrying about building a "special SaaS model" when all I really needed was:

- Solid contract tracking

- Clear revenue recognition rules

- Standard three statement structure

Once I figured that out, everything else fell into place.

The SaaS metrics and KPIs are just ways to analyze what's already in your model.

So next time someone asks you for a "SaaS model template," remember: it's mostly underlying revenue and cost drivers feeding back into the three statements.

That's it for today. See you next time.

—Chris

p.s., if you enjoyed this post, then please consider checking out my Financial Modeling Courses. As featured by Wharton Online, Wall Street Prep, and LinkedIn Learning, you'll learn to build the exact models I use with Investment Banks, FP&A Teams, and Private Equity Firms 👉 Click here to learn more.