Why Is My Balance Sheet Not Balancing?

Trust me, I know how frustrating it is when you balance sheet doesn't balance.

So let's keep it short and tactical today.

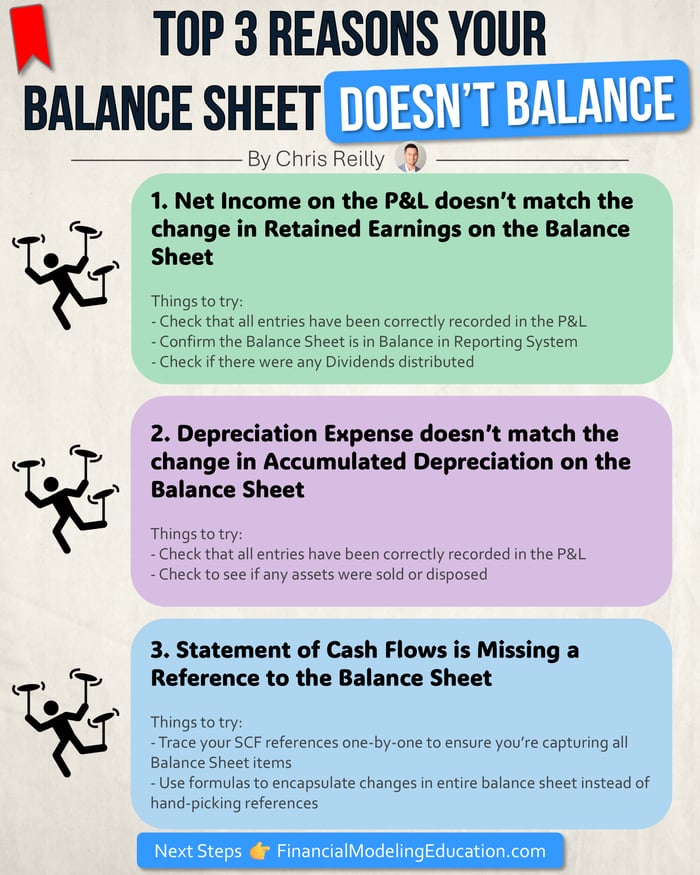

These are the top three reasons I usually see in client models that lead to a busted Balance Sheet.

Issue 1. Net Income Doesn't Match Retained Earnings

What should be happening:

The Net Income from your Income Statement should match the change in Retained Earnings on your Balance Sheet.

If there's a difference, here's what you can try:

1a. Determine if any Distributions were made

An equity distribution comes out of Retained Earnings, and the journal entry looks like this:

Debit (decrease) Retained Earnings Credit (decrease) Cash

So, the difference you're looking just might be an equity distribution.

Some companies will have a separate negative account called "Distributions," whereas others will keep everything in Retained Earnings.

1b. Check that all entries were recorded correctly in the P&L

Happens more often than you think: an entry in the P&L might not be correct, which disconnects the Net Income from the Balance Sheet.

1c. Confirm Balance Sheet balances in Reporting System

This is less common (since systems usually have checks for this) but it does happen.

Confirm your raw data is correct first. Any error here would show up in your model as well.

Issue 2. Depreciation Expense doesn't match change in Accumulated Depreciation

What should be happening:

The Depreciation Expense from your Income Statement should match the change in Accumulated Depreciation on your Balance Sheet.

If there's a difference, here's what you can try:

2a. Check to see if any assets were sold or disposed

When a company sells or disposes of a depreciable asset, it removes the book value of the asset from the Fixed Assets section of the balance sheet, and it also removes the accumulated depreciation associated with that asset from the accumulated depreciation account.

The exact cash proceeds may not always be clear, so you'll want to ask the Accounting team:

- Was anything sold, and if so, what were the cash proceeds?

- Did the company recognize a gain or loss?

The cash received from the sale would show up in the Investing Section of the Cash Flow Statement, whereas the Gain or Loss would show up in the Operating Section.

2b. Check that all entries were recorded correctly in the P&L

Similar to above, sometimes there are errors in the journal entries. Reach out to the Bookkeeper or Controller who is making these entries to double-check.

(less common but it happens)

Issue 3. The Statement of Cash Flows is Missing a Reference to the Balance Sheet

This would be a modeling error.

Since 3 Statement Models use the indirect method to calculate cash, sometimes as modelers we can miss something.

Things to try:

- Trace all of your SCF references to ensure you've captured every line item on the Balance Sheet (except for cash).

- Make sure all changes in Assets are Previous Period - Current Period

- Make sure all changes in Liabilities and Equity are Current Period - Previous Period

- If you want to get fancier, you could use formulas to capture changes in the entire Balance Sheet, instead of hand-picking the individual line items. Here's an example.

Zooming Out

I would say 80-90% of the time, one of the three culprits above is to blame for a broken Balance Sheet.

So be sure to add this checklist to your financial modeling toolkit.

That's it for today. See you next time. —Chris

📕 p.s. VLOOKUP or XLOOKUP?

Spoiler Alert: your boss doesn't care.

Focus on what matters.

I've helped over 30,000 FP&A and Private Equity professionals master Financial Modeling in just one week without the high cost of traditional education.