Introduction:

SDE vs Adjusted EBITDA, what exactly is the difference?

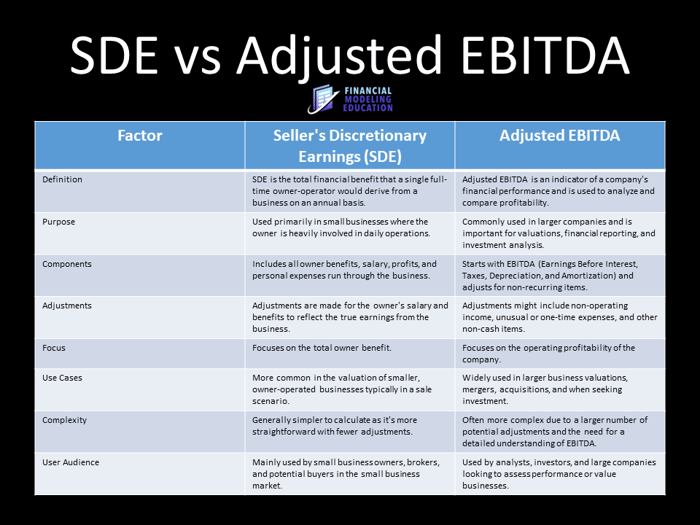

When assessing the financials of a company, two terms often surface in the realm of valuation and profitability analysis: Seller's Discretionary Earnings (SDE) and Adjusted EBITDA.

I used to think they were basically the same thing, but in truth there are some nuances between them.

These differences are important for finance professionals to know when assessing the financial health of a company and ultimately moving towards a valuation.

This post will dive into these concepts and provide clarity on when and how to use them effectively.

Let's get started...

Btw, if you like this post, please consider joining my free email series on Financial Modeling. Serious inquires only, thanks.

The Big Picture

Zooming way out, SDE and Adjusted EBITDA are used as the basis for valuation.

In most instances, these figures will be multiplied by some kind of "market multiple" to arrive at a valuation.

For example, if a company has SDE of $400k, and "market multiples" of similar companies are 3.0x, then the valuation is $1.2 million ($400,000 x 3 = $1,200,000).

The same "market multiple" logic applies for EBITDA.

Exploring Adjusted EBITDA:

Adjusted EBITDA Explained:

Adjusted EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, adjusted for non-recurring, discretionary, or even "pro forma" expenses.

It is typically used to value larger businesses.

Here's the thesis: calculate the normalized earnings of the company (so it is comparable to others).

However, unlike SDE (which we'll discuss below), we don't include any Owner Salary in our calculation, because it is assumed anyone running the day-to-day operations of the company is an employee, not an owner or investor (like a PE fund).

Adjusted EBITDA Calculation:

To build Adjusted EBITDA, we start with Net Income and then adjust for any extraordinary, non-operating, or non-cash items.

Reminder, you won't see any Owner's Salary.

Here's a detailed example:

In this example we've started with Net Income, but we've "added-back" several items:

- The "Standard" ones: Interest, Taxes, Deprecation, Amortization

- The "Discretionary" ones: Discontinued channels or one-off expenses

- The "Transactional" ones: Transaction expenses and Management Fees

- The "Pro Forma" ones: Forward-looking adjustments we know are coming

This schedule mirrors something you will likely find in a Quality of Earnings or "QofE" analysis.

Deep Dive into SDE:

SDE Defined:

Seller's Discretionary Earnings (or "SDE") is a metric primarily used to value small to medium-sized businesses.

It represents the total financial benefit a single, full-time owner-operator would derive from a business on an annual basis.

This includes not just the profits, but also the owner's salary, benefits, and any personal expenses passed through the business.

The Use of SDE:

It's primary use case comes when such a business is being prepared for sale, as it provides a more comprehensive view of the financial returns available to a potential buyer.

If you've ever explored purchasing a company from a listing site like BizBuySell, it's very common to see SDE used as the "profitability metric" instead of Adjusted EBITDA.

Calculating SDE:

I like to think of SDE as "Adjusted EBITDA+": you start with the Net Income and add-back your standard adjustments, but then you also add-back any owner-specific expenses, salaries, and benefits.

This adjustment is made to showcase the full economic benefit to the owner, which would be transferable to a buyer.

Here's a basic example:

You can see we start by modeling Adjusted EBITDA first, then adding the Owner's Salary and any Personal Expenses paid by the Company (hence why I think of it in my head as "Adjusted EBITDA+").

For a more robust example, take a look at this beautiful Financial "Recast" (a term often used by Business Brokers) put together by Midstreet Mergers & Acquisitions:

Source: Midstreet Mergers & Acquisitions.

Source: Midstreet Mergers & Acquisitions.

Financial Recast Notes (from the Midstreet article):

A – Officer’s Salary is added back to show what one full-time owner-operator can receive from the business. Note: If multiple owners participate in daily operations, add back one full-time owner and adjust the expenses to an amount equal to what it would cost to hire an employee/s to replace the additional owners.

B – Company's share of owner's payroll taxes are added back

C – Charitable contributions are not critical to operation of the business

D – Non-recurring expense of equipment damage is added back into net profit

E – Buyer will have their own depreciation schedule

F – Personal telephone bill added back

G – Personal fuel expense added back

H – Buyer won’t be paying same interest

SDE vs Adjusted EBITDA - The Comparative Analysis:

While both SDE and Adjusted EBITDA aim to provide a clear picture of financial benefits or operational profitability, their application differs based on the size and nature of the business being analyzed.

Again, the reason that the Owner's Compensation is not reflected in Adjusted EBITDA is because it is assumed that the person running the day-to-day operations is an employee, whereas the owner is likely an institution (like a Private Equity firm).

Key Differences:

SDE is for smaller, personal businesses; Adjusted EBITDA is for larger entities.

While there's no hard-and-fast rule, deals I've seen usually calculate SDE for companies with $2mm of earnings or less, whereas EBITDA kicks in above $2mm and is the standard from there.

Again, no concrete rule, it's more about the day-to-day business operations and owner involvement.

Conclusion:

Ultimately it comes down to Owner involvement in the day-to-day operations.

If an "Owner/Operator" will be needed day-to-day on a go-forward basis, then SDE is likely the best valuation metric.

However, if the new owner likely won't be involved in the day-to-day (and that person would need be hired), then EBITDA is typically your best bet.

If you want to learn more about financial modeling, please consider subscribing to my free email series, the Financial Modeling Educator.