What's a "LBO" ?

Talk about another finance term designed to confuse me.

"LBO" stands for "Leveraged Buyout."

But,

What the heck does that mean?

Let's simplify:

All a Leveraged Buyout means is you borrowed money to buy something.

Bought a house (and took out a mortgage)?

Leveraged Buyout.

Bought a car (and financed some of it)?

Leveraged Buyout.

Bought a TV (and put it on your credit card)?

Leveraged Buyout.

Friend loan you a few bucks to buy a beer?

Leveraged Buyout.

We are just borrowing to buy something.

———

LBOs are used in private equity all the time.

And although they're often cryptically explained,

they break down into 2 simple pieces:

▪️ the Equity

▪️ the Debt

Add them together and you get the Purchase Price.

If a business costs $1,000,000 — a LBO might look like this:

▪️ Put in Cash (Equity) of $400,000

▪️ Borrow Debt of $600,000

= Total = $1,000,000

The Debt (or "Leverage") has been borrowed to buy this business.

(and will eventually need to be paid back)

———

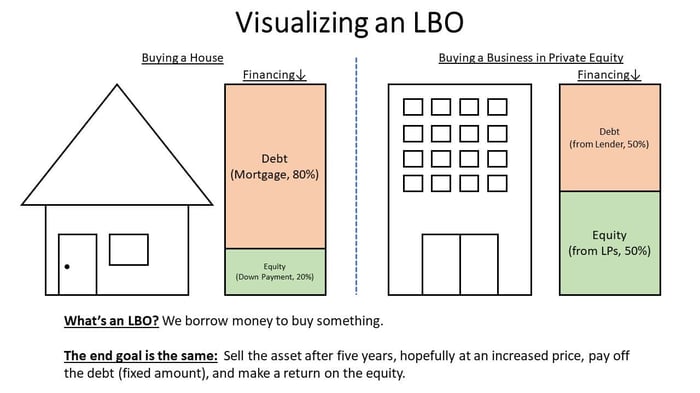

Take a look at the picture below.

On the left is a house.

The mortgage is the borrowed portion used to buy the house.

The equity is the rest.

Together, they add up to the purchase price.

———

Now, look at the picture on the right.

It's a business.

But, it's purchased just like a house.

The debt is borrowed, and the equity is the remainder.

Together, they add up to the purchase price.

When it's all said and done, the end goal is the same.

Sell the asset (house or business) after some time has passed.

Hopefully, the price has increased.

You pay off any debt that you still have.

The rest of the cash goes to the equity (the homeowner or investor).

If you get more equity out than you put in, then you've made a positive "return."

———

And there you have it.

An LBO.

———

About Me -- If you've never seen my stuff before, I'm Chris -- from skyscraper to Solopreneur -- I teach Financial Modeling (like a human, not a textbook).

Here's the best way I can help you.

Until next time.

--Chris