What's a Teaser?

Last week we talked through the big picture. The "roadmap" to closing a deal.

Before you punch anything into a model, the very first document you will receive is something called a "Teaser," and it usually comes from an Investment Bank (if you're in an "auction style" deal).

Let's explore this very first step and how it affects "the model..."

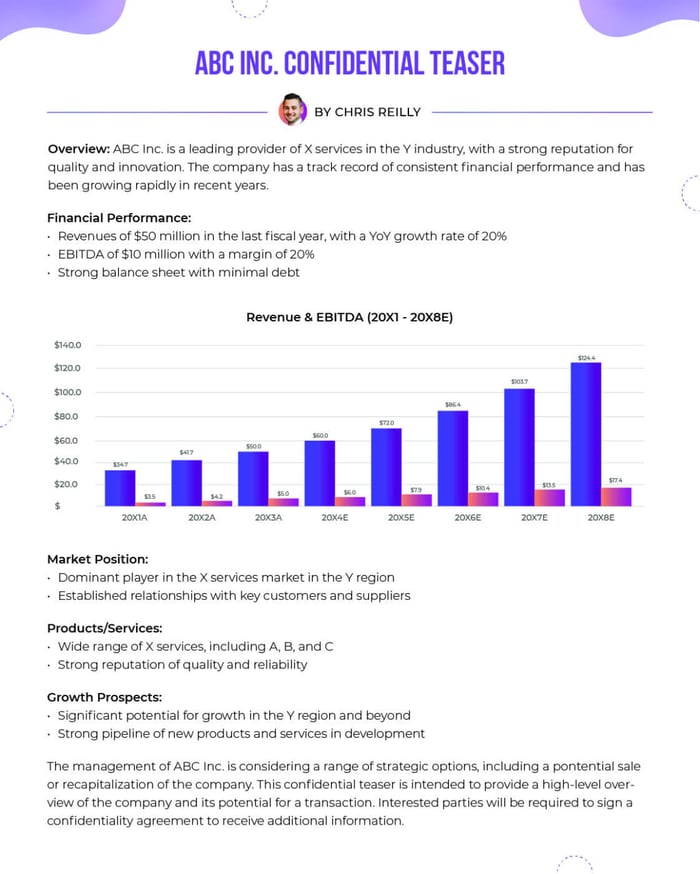

Sample Teaser

Big Picture:

A "Teaser" is just a preliminary document that provides an overview of a company and its financial performance, as well as its potential for a merger, acquisition, or other transaction.

Generally Prepared By:

An Investment bank to initiate a discussions with potential buyers or investors and usually sent to a "known group" of sponsors (PE firms) before being distributed to a wider audience.

The common term for this scenario is called "running a process."

Goal:

To attract formal interest to complete a transaction and create a little bit of a "bidding war" over price to maximize value for the seller.

Very similar to multiple people looking to purchase a house, the Investment bank is trying to create "deal tension" to keep interest and price high.

What the "Sponsor" (PE firm / investor) does:

Here's where the basic modeling comes in.

You would take this very preliminary information and plug it into a cookie-cutter model template, run a few stress tests / downside scenarios and decide if there's enough interest to get more details.

This model is typically a pre-built one-pager that takes no more than 20-30 minutes to complete.

Remember my note above about "deal tension?" The Investment bank (and therefore, seller) is trying to make this opportunity as attractive as possible, which means it always includes "rosy" projections that need to be discounted heavily.

It's not that the projections are unrealistic, it's just that you're usually seeing "Upside Case+" in these types of documents, so you need to haircut things in a meaningful way before you decide if the deal is actually worth your time.

Next Steps:

Let's say after some basic modeling the deal looks interesting enough to learn more.

The sponsor (PE firm) signs an NDA and then receives the formal pitchbook or "CIM" (Confidential Information Memorandum) that gives all the details including company name, management team, and detailed financial performance.

This is the 80-100 page "deal Bible" I mentioned in last week's email, and this will inform a much more robust Financial Model.

In Summary

This little document is designed to create interest and deal tension, but not much else. You'll also have a handful of conversations with the Investment bank (often called the "sell side" rep), which effectively serves as an introduction to who you could be working with for the next several months.

You're just feeling things out or "kicking the tires" as people love to say, but it's the first step of many for what's to come.

That's it for today. See you next time. —Chris